Can Dividend ETFs Create Passive Income? The 2025 Guide to Living on Yield

Imagine a paycheck that arrives in your bank account whether you work 60 hours this week or spend it sleeping on a beach. It’s taxed at a lower rate than your salary, it arrives like clockwork, and historically, it grows faster than inflation. That is the promise of dividend ETFs.

But here is the uncomfortable truth I’ve learned after years of analyzing portfolios: Most people get “passive income” wrong. They chase double-digit yields, fall into “traps” that erode 40% of their capital, and end up with less money than they started with.

You might be wondering, “Can I actually live off these things?” The short answer is yes. But the mechanism isn’t magic; it’s math.

According to Hartford Funds, from 1960 through 2023, 85% of the cumulative total return of the S&P 500 Index can be attributed to reinvested dividends. If you ignore dividends, you are ignoring the primary engine of market wealth.

In this guide, we are going to break down the exact math, the 2025 tax loopholes that can save you thousands, and the specific portfolio construction needed to generate reliable monthly income.

The Mechanics: How Dividend ETFs Generate Passive Cash Flow

To understand if dividend ETFs for passive income are right for you, you first have to understand the engine under the hood. Unlike a savings account where the bank pays you interest, an ETF (Exchange Traded Fund) is a “passthrough” vehicle.

Yield vs. Growth: The Balancing Act

When you buy a share of a company like Coca-Cola or Johnson & Johnson, you become a partial owner. When they make a profit, they cut you a check. An ETF bundles hundreds of these companies together.

However, not all yields are created equal. As of December 2024, data from YCharts shows the S&P 500 dividend yield sitting near historic lows of roughly 1.27%. If you have $100,000 invested in the broad market, that’s only $1,270 a year in income. That won’t pay the rent.

To create livable passive income, we need to look at specialized funds—strategies like High dividend yield ETFs or Dividend Growth Investing. These funds specifically select companies that pay 3%, 4%, or even 5% yields.

The “Passthrough” Mechanism

ETFs collect dividends from the hundreds of stocks they hold. They hold these funds in a trust and distribute them to you. While most pay quarterly, there is a rising class of quarterly vs monthly dividend ETFs designed specifically for retirees who need consistent cash flow to match their bill cycles.

One thing that surprised me when I first started investing was how fees eat income. According to ETF.com, the average expense ratio for passive index dividend ETFs is now approximately 0.06% (e.g., VIG, SCHD). Compare that to active funds charging 0.50%+, and you realize that keeping costs low is the first step to high income.

The Math of Freedom: How Much Do You Actually Need?

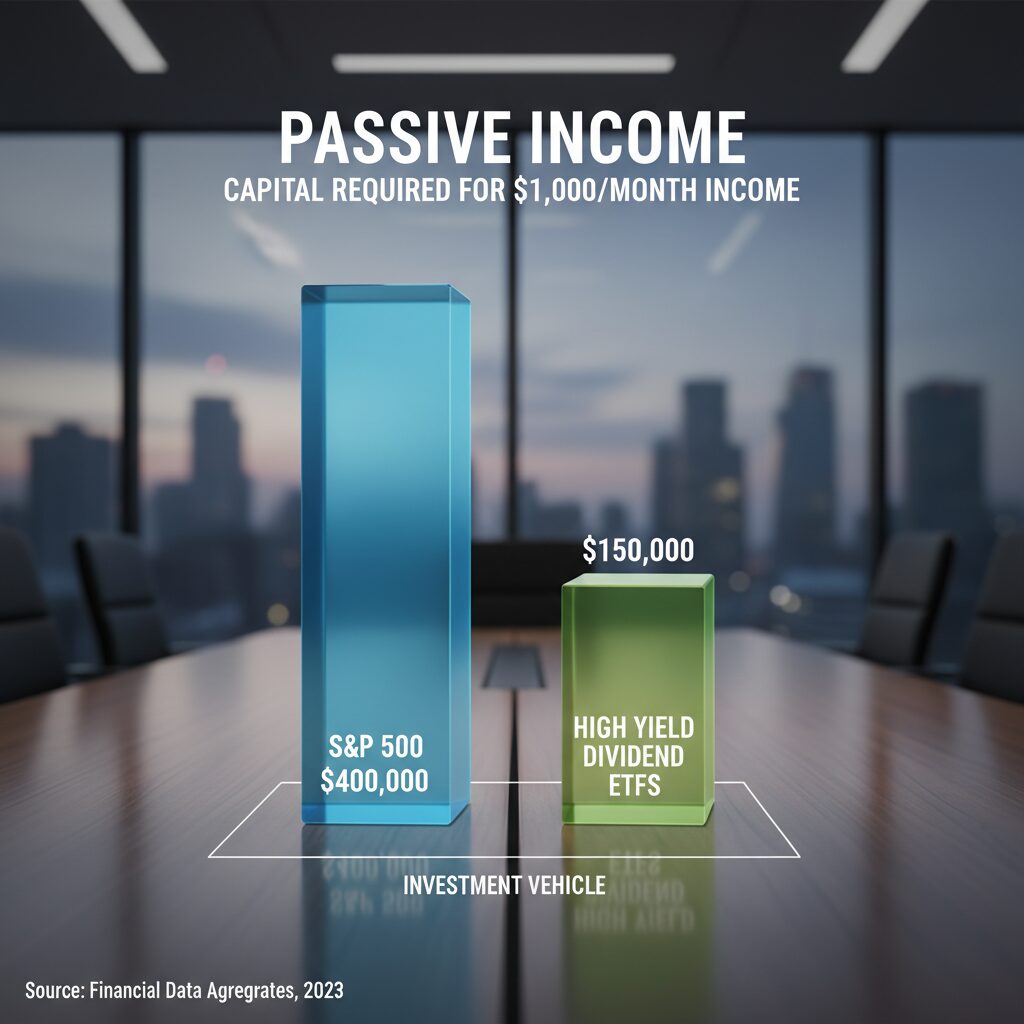

Let’s get practical. How much capital do you actually need to generate a “Freedom Fund” of $1,000 a month? This is where the choice of ETF changes your life trajectory.

The $1,000/Month Formula

If you rely on the standard S&P 500 yield of 1.27%, the capital requirement is massive. But if you shift to a high-quality dividend fund like the Schwab U.S. Dividend Equity ETF (SCHD), which offered a trailing 12-month distribution yield of approximately 3.4% entering 2025 (according to Schwab Asset Management), the math changes dramatically.

- Scenario A (S&P 500 @ 1.27%): You need roughly $944,881 invested to get $1,000/month.

- Scenario B (High Dividend ETF @ 3.4%): You need roughly $352,941 invested to get $1,000/month.

By choosing a specialized Dividend ETF over the broad market, the capital requirement to reach financial independence drops by over 60%. That is the difference between retiring at 65 and retiring at 50.

The Power of DRIP (Dividend Reinvestment Plan)

If you don’t need the income immediately, the “Snowball Effect” takes over. A Dividend reinvestment plan (DRIP) automatically uses your dividend payments to buy more shares of the ETF.

It’s compound interest on steroids. You get paid dividends, those dividends buy more shares, and next quarter, you have more shares paying you dividends. It creates a feedback loop that accelerates wealth.

🧮 ETF Passive Income Calculator

Estimate how much capital you need to generate your desired monthly income.

The “Yield Trap” Danger Zone

Now, here is where it gets dangerous. I often see new investors sorting ETFs by “highest yield” and buying funds paying 11% or 12%. This is usually a mistake.

In the industry, we call this a Yield Trap. A yield trap occurs when an ETF’s share price collapses, artificially inflating the yield percentage, or when the underlying companies are paying out more cash than they earn.

Red Flags to Watch In 2025

- Payout Ratios > 75%: If a fund’s holdings are paying out nearly all their earnings, they have no cash left to grow. As of late 2024, the average dividend payout ratio for the S&P 500 was roughly 35.78% according to FactSet Data, leaving significant room for safety. Anything double that is risky.

- Declining NAV (Net Asset Value): If a fund pays you 10% in dividends but the share price drops 10% a year, your total return is zero. You are just getting your own money back, typically taxed.

2025 Tax Implications for Dividend Investors

Passive income is great, but tax-free passive income is better. One of the biggest advantages of Dividend ETFs over other income sources (like bond interest or REITs) is the tax treatment.

Qualified vs. Non-Qualified Dividends

Most dividends from US-based ETFs are considered “Qualified Dividends.” This means they are taxed at the long-term capital gains rate (0%, 15%, or 20%) rather than your ordinary income tax rate (which can go up to 37%).

According to IRS Revenue Procedure 2024-40, the 2025 tax brackets are incredibly generous for dividend investors.

For the 2025 tax year, the 0% qualified dividend tax rate applies to taxable income up to $48,350 for single filers and $96,700 for married filing jointly. This means a retired couple could theoretically earn nearly $100,000 in dividends (assuming no other income) and pay $0 in federal taxes.

However, this reinforces why you must hold these assets in the right accounts. Placing high-yield assets in Tax-advantaged accounts (Roth IRA) can eliminate taxes entirely, regardless of your income bracket.

Top 3 Dividend ETF Contenders for 2025

I have analyzed dozens of funds, looking for the sweet spot between yield, safety, and growth. Based on the Dividend Aristocrats list 2025 data and current market conditions, here are the top three contenders.

1. The All-Rounder: Schwab US Dividend Equity (SCHD)

If you ask any serious dividend investor what their core holding is, they will likely say SCHD. It tracks the Dow Jones U.S. Dividend 100 Index.

- Why it works: It screens for quality fundamentals—cash flow to debt, return on equity, and dividend growth rate. It doesn’t just buy high yield; it buys quality.

- The Stats: With a yield hovering around 3.4% and a history of double-digit dividend growth, it hedges against inflation.

2. The High Yielder: Vanguard High Dividend Yield (VYM)

For those needing immediate income, VYM is a powerhouse. It tracks the FTSE High Dividend Yield Index.

- Why it works: It holds over 400 stocks, providing massive diversification. It leans heavily into financials, consumer staples, and energy.

- The Expert View: Morningstar analysts have consistently praised its low turnover and rock-bottom expense ratio.

3. The Grower: Vanguard Dividend Appreciation (VIG)

This is for the investor who doesn’t need income today but wants a massive income stream 10 years from now.

- Why it works: VIG focuses on Dividend growth investing. It buys companies that have increased dividends for at least 10 consecutive years. The yield is lower (around 1.8% – 2.0%), but the capital appreciation is significantly higher.

Building Your “Forever Income” Portfolio

So, how do you put this together? I recommend the “Core & Explore” strategy. You don’t put all your eggs in one basket.

— Daniel Sotiroff, Senior Analyst at Morningstar (2025 Report)

The 80/20 Rule

Consider allocating 80% of your dividend portfolio to “Core” holdings like SCHD or VYM. These are your safety nets. They are filled with blue-chip companies that have survived recessions.

Use the remaining 20% for “Explore” plays—perhaps a higher-risk covered call ETF or a specific sector ETF (like Utilities or Real Estate) to boost your overall yield, but only if you can stomach the volatility.

Withdrawal Strategies: Selling vs. Yield

The ultimate goal is to live off the yield without selling the shares. This preserves your principal (the Golden Goose) while you consume the eggs. However, in years where the market is down, having a solid dividend yield prevents you from having to sell shares at a loss to pay bills. This is known as “Sequence of Returns Risk” mitigation.

Frequently Asked Questions

Can you live off dividend ETFs?

Yes, absolutely. However, it requires significant capital. To generate $50,000/year at a safe 3.5% yield, you need approximately $1.4 million invested. It is a long-term strategy, not a get-rich-quick scheme.

Are dividend ETFs taxed as ordinary income?

It depends. Most ETFs holding US stocks pay “qualified” dividends taxed at 0%, 15%, or 20%. However, ETFs holding bonds, REITs, or using covered call strategies often pay distributions taxed as ordinary income (up to 37%). Always check the fund’s prospectus.

What is the safest dividend ETF?

While no investment is risk-free, the Vanguard Dividend Appreciation ETF (VIG) is often considered one of the safest because it focuses on companies with strong balance sheets that have a history of raising dividends, rather than distressed companies with high yields.

Do dividend ETFs compound automatically?

Not by default. You must enable a Dividend Reinvestment Plan (DRIP) inside your brokerage account. Once enabled, every dividend payment is automatically used to buy fractional shares of the ETF, accelerating your compound growth.

Conclusion: The Snowball Starts Now

Can dividend ETFs create passive income? Yes. In fact, for most investors, they are the superior choice compared to buying individual stocks or managing rental properties. They offer liquidity, diversification, and tax efficiency that is hard to beat.

But remember the warning signs. Avoid yield traps offering 10%+ returns if the underlying assets are eroding. Stick to the boring, reliable performers like SCHD and VYM.

The best time to plant a tree was 20 years ago. The second best time is today. Whether you have $100 or $100,000, the math of compounding works the same. Start your snowball, enable DRIP, and let time do the heavy lifting.