How to Get Passive Rental Income: The 2025 Strategy Guide

The definitive blueprint for navigating the “Passive Spectrum,” mastering DSCR loans, and maximizing returns in a cooling 2025 market.

Let’s be real for a moment: “Passive income” in real estate is usually a lie. Or at least, it’s a gross exaggeration sold by influencers who have never unclogged a toilet at 2 AM.

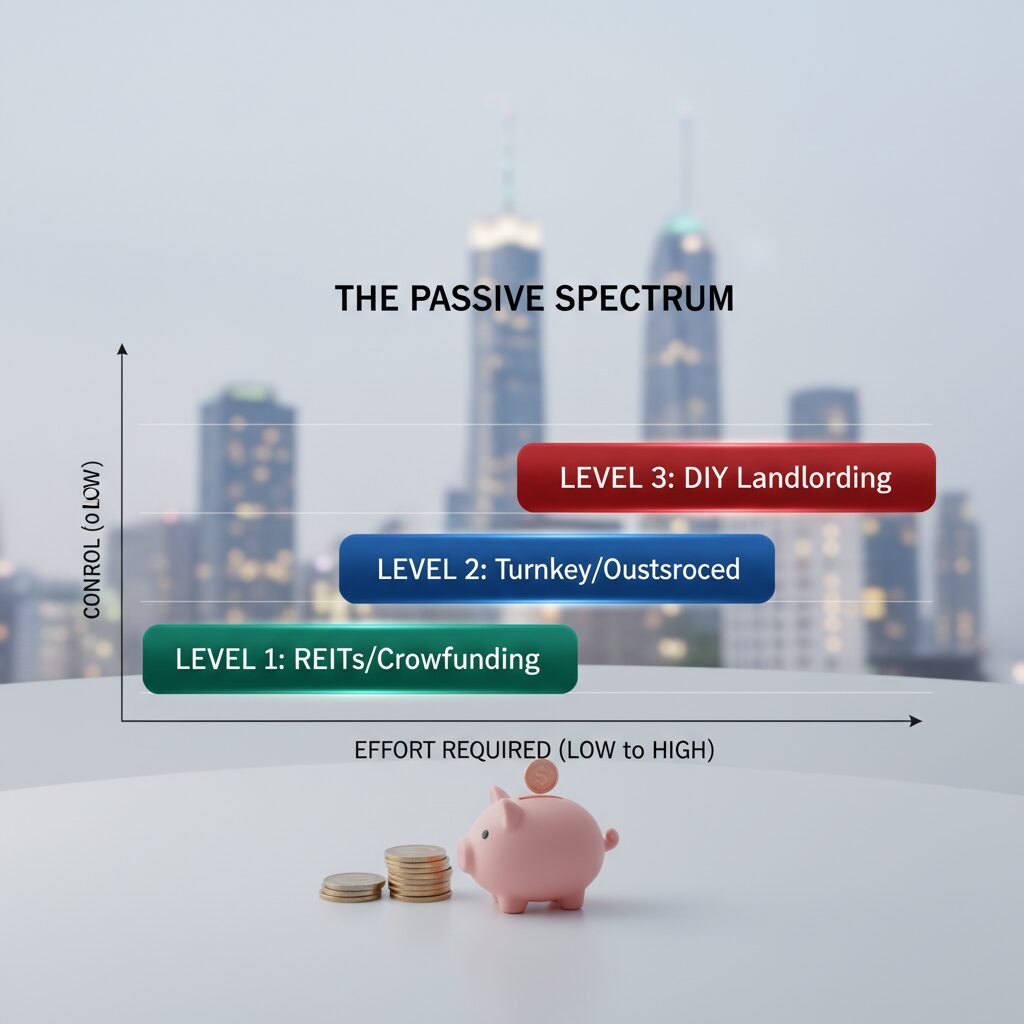

In my decade of analyzing real estate portfolios, I’ve found that rental income falls on a spectrum. On one end, you have high-effort, high-return active landlording. On the other, you have lower-return, truly hands-off investing. The problem is, most investors get stuck in the middle—doing maximum work for minimum return.

The 2025 market has changed the rules. With bonus depreciation dropping to 40% and asking rents falling 0.7% year-over-year according to Redfin, the old “buy and pray” method is dead. You need a surgical approach.

This guide is your 2025 roadmap. We will break down the “Passive Spectrum,” expose the hidden costs of property management, and show you exactly how to structure your portfolio to ensure the income is actually passive.

The “Passive Spectrum”: Choosing Your Level

Before you spend a dime, you must decide how much “passivity” you can afford. The biggest mistake I see beginners make is buying a single-family home across the country, thinking a property manager makes it passive. It doesn’t.

We categorize income strategies into three levels:

- Level 1: True Passive (The “Mailbox Money” approach). You write a check; someone else does everything. Zero control, consistent but lower returns.

- Level 2: Outsourced Ownership (The Sweet Spot). You own the asset and make high-level decisions, but pros handle the day-to-day.

- Level 3: Hybrid Active. Strategies like House Hacking or BRRRR where you trade sweat equity for higher returns. (We will skip this today as it is not passive).

Level 1: “True Passive” (Hands-Off Investing)

If you have a demanding W2 job or simply hate the idea of dealing with tenants, this is your lane. In 2025, technology has democratized this level significantly.

1. REITs (Real Estate Investment Trusts)

Think of REITs as the mutual funds of real estate. You buy shares of companies that own commercial properties, apartments, or hospitals. They are required by law to distribute 90% of their taxable income to shareholders.

Performance has been resilient. According to Nareit, REITs rose 4.9% in 2024 despite economic headwinds. While this isn’t the double-digit explosion of 2021, it offers liquidity that physical property cannot match.

2. Real Estate Crowdfunding

This is where the 2025 market gets interesting. Platforms like Arrived and Fundrise allow you to buy fractional shares of specific projects. But they operate very differently.

The “Blind Pool” vs. “Specific Asset” Choice:

- Fundrise (eREIT): You invest in a fund. The managers pick the assets. It’s diversified but opaque.

- Arrived (Fractional): You browse a marketplace and buy shares of a specific rental home in Atlanta or Nashville.

Avg. Dividend Yield (Arrived, Q4 2024)

Fundrise Income Fund (Est. 2024 Return)

According to Arrived Homes, their single-family residential properties earned an average annualized dividend of 4.0% in Q4 2024. While this yield is lower than a high-yield savings account, the upside is appreciation—you own a share of the home’s equity growth.

Level 2: Outsourced Ownership (The Sweet Spot)

This is for the investor who wants the tax benefits of direct ownership (which REITs don’t fully offer) but doesn’t want to fix toilets. The strategy here is Turnkey Investing.

The Turnkey Model

A turnkey provider finds a distressed property, renovates it, places a tenant, and sells it to you. You own the deed, but they manage it.

However, 2025 brings a unique challenge: Rent Stagnation. CoreLogic data shows single-family rent prices increased only 1.8% year over year in December 2024, the lowest growth in four years. This means you cannot rely on rapid rent hikes to fix bad math.

The “Passivity Tax” Calculation

True passivity in direct ownership comes with a price tag. You must account for Property Management (PM) fees to keep it hands-off. According to Leasey.AI, average management fees in 2025 range from 8% to 12% of gross rent.

The Calculation:

(Gross Rent × 10% Mgmt Fee) + (Gross Rent × 5% Vacancy Factor) + (1 Month Rent for Tenant Placement) = True Cost of Passivity.

If you ignore these costs, you aren’t an investor; you’re a speculator.

The 2025 Financial Reality: Costs & Returns

If you are buying property in 2025, the financing landscape has shifted. The days of 3% interest rates are gone, but a new tool has become the standard for passive investors: the DSCR Loan.

Mastering DSCR Loans (No Income Verification)

A DSCR (Debt Service Coverage Ratio) loan doesn’t care about your W2 income. It looks at the property’s cash flow. If the rent covers the mortgage, you qualify.

According to HomeAbroad, as of December 2025, DSCR loan interest rates range from 6.12% to 6.62% for top-tier borrowers. While higher than conventional mortgages, they allow you to scale without hitting the “10 financed properties” limit that banks impose.

Vacancy Reality Check

You must underwrite conservatively. U.S. Census Bureau data reveals that national rental vacancy rates hit 6.9% in the third quarter of 2024. If your pro-forma assumes 0% vacancy, you are setting yourself up for failure. I recommend underwriting a standard 8% vacancy rate for 2025 acquisitions.

Passive Income Calculator (2025 Est.)

Estimate your monthly cash flow after the “Passivity Tax”.

The “Tax Alpha”: Keeping More of What You Make

The single greatest advantage of rental income over stock dividends is the tax treatment. However, the Tax Cuts and Jobs Act (TCJA) phase-outs are hitting hard in 2025.

The 40% Bonus Depreciation Cliff

In 2024, you could deduct 60% of eligible property value in Year 1. In 2025, that drops to 40%. This means if you buy a rental property, you can’t write off nearly as much upfront.

The Solution: Cost Segregation Studies.

Even with the drop to 40%, a cost segregation study allows you to accelerate the depreciation of non-structural elements (flooring, lighting, fencing) over 5 or 7 years instead of 27.5 years. For a $500,000 property, this can still result in a $40,000+ deduction in the first year.

“While the bonus depreciation phase-down is a headwind, the ability to offset W2 income using the Real Estate Professional Status (REPS) or the Short-Term Rental loophole remains the most powerful wealth-building tool in the tax code.”

5 Risks That Kill Passive Income (And How to Fix Them)

Passive income stops being passive when problems arise. Here are the risks I’m watching closely in 2025:

- The “Zombie” Listing: Buying based on 2023 projected rents. Always verify current rents using local property managers, not Zillow estimates.

- Vacancy Spikes: Jamie Lane, Chief Economist at AirDNA, noted that while occupancy stabilized in 2024, supply growth is still putting pressure on owners. Source. Fix: Price your unit 5% below market to secure long-term tenants quickly.

- Interest Rate Volatility: If you use a DSCR loan with an ARM (Adjustable Rate Mortgage), you are gambling. Fix: Lock in fixed rates, even if they are slightly higher.

- Bad Property Management: A bad manager will cost you more than the 10% fee in lost rent. Fix: Audit your manager quarterly. Are repairs taking too long? Is communication slow?

- CapEx Surprises: HVACs break. Roofs leak. Fix: Keep a separate reserve fund of 3-6 months of expenses per property.

Conclusion: Your Action Plan

Generating passive rental income in 2025 is less about “finding a deal” and more about operational efficiency and correct financing.

Here is your roadmap based on your available capital:

- $1,000 – $10,000: Stick to REITs or Crowdfunding (Arrived). You cannot afford the friction costs of direct ownership yet. The 4-5% yields are safe and truly passive.

- $20,000 – $50,000: Look at Turnkey properties in the Midwest or South using a DSCR loan. Leverage the bank’s money to acquire the asset, but account for the 8-12% management fee.

- $100,000+: Consider Syndications (private placements) or building a portfolio of small multifamily units. At this level, the cost of a cost segregation study becomes worth it for the tax benefits.

The market has cooled, but that removes the frenzy. It allows smart investors to buy based on math, not hype. Choose your level on the Passive Spectrum, run your numbers conservatively, and build a portfolio that pays you while you sleep.