10 Best Monthly Dividend Stocks for Passive Cash Flow in 2025

Stop waiting 90 days to get paid. Imagine your portfolio paying your rent, mortgage, or grocery bill every single month like clockwork.

We’ve all been there. You look at your brokerage account, see a healthy balance, but realize your actual cash flow is lumpy. Most companies pay dividends quarterly, which creates a mismatch with real life—because your bills don’t wait three months to arrive. This is why monthly dividend stocks are the “holy grail” for retirees and the FIRE (Financial Independence, Retire Early) community.

But here is the harsh reality I’ve seen in my 15 years of analyzing income portfolios: Most monthly payers are traps. They offer seductive 12% yields right before slashing the dividend and destroying your capital.

In this guide, we aren’t just listing tickers. We are analyzing over 3,000 stocks to find the “Safe Elite”—companies with sustainable payout ratios that have paid uninterrupted monthly income for decades. We will also expose the massive tax mistake most investors make with REITs.

Why Choose Monthly Dividends Over Quarterly?

Beyond the obvious psychological benefit of matching your income to your expenses, there is a mathematical advantage to monthly stocks: Compounding frequency.

It’s simple math, but it’s powerful. When you reinvest dividends monthly rather than quarterly, your money starts working for you 8 times sooner each year. According to Nasdaq analysis on dividend compounding, this creates a “snowball effect” that accelerates total returns over a 10-20 year horizon.

However, the real value isn’t just the 0.5% extra return. It’s behavior. In 2022, when the S&P 500 dropped 19%, investors holding monthly payers like Realty Income (O) were less likely to panic sell because they saw cash hitting their account every 30 days. As Kristy Akullian, Head of iShares Investment Strategy, noted in their 2025 Investment Directions, “We prioritize income over price appreciation” in volatile environments to keep investors on track.

Top 3 “Sleep Well at Night” Monthly Dividend Stocks

We filtered the market for companies with a history of rising dividends and, crucially, a safe payout ratio relative to their Funds From Operations (FFO).

1. Realty Income (O) – The Gold Standard

NYSE: O

If you own only one monthly dividend stock, this is usually it. They literally trademarked the phrase “The Monthly Dividend Company®.” Realty Income owns over 13,000 properties, leasing them to recession-resistant tenants like Walgreens, 7-Eleven, and Dollar General.

~5.66%

665+ Months

Low/Medium

Why it’s a buy in 2025: According to Realty Income’s investor data, the company has declared 665 consecutive monthly common stock dividends throughout its 55-year operating history. While interest rates were a headwind in 2023-2024, the 2025 stabilization makes their cost of borrowing cheaper, widening their profit margins.

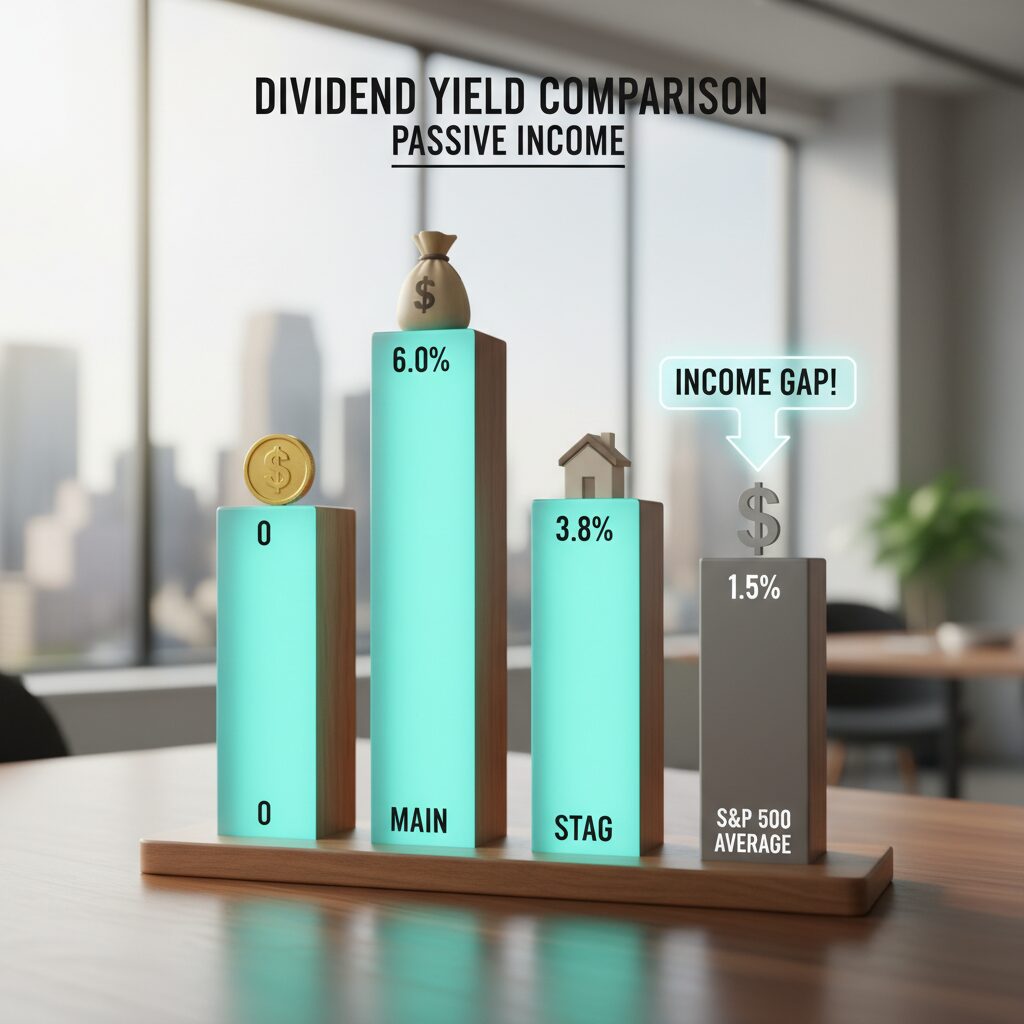

2. Main Street Capital (MAIN) – The BDC Leader

NYSE: MAIN

Main Street Capital is a Business Development Company (BDC) based in Houston. Think of them as a bank for small-to-medium-sized businesses that can’t get loans from big banks like Chase. They lend money and take equity stakes in these companies.

~6.79%

Monthly + Special

The “Special” Bonus: Unlike most companies that just pay a flat rate, MAIN frequently pays supplemental dividends when profits are high. According to Main Street’s dividend history, they have never decreased their regular monthly dividend rate, even during the 2008 crash and the 2020 pandemic. That is resilience.

3. Stag Industrial (STAG) – The E-Commerce Play

NYSE: STAG

Do you shop on Amazon? STAG likely owns the warehouse your package came from. Approximately 40% of their portfolio handles e-commerce fulfillment. Unlike Realty Income (which owns retail stores), STAG owns the industrial backbone of America.

According to S&P Global Market Intelligence, industrial real estate demand remains robust in 2025 as on-shoring of manufacturing continues. This gives STAG a long growth runway, making it a “growth + income” hybrid play.

The High-Yield ETF Solution: Instant Diversification

Picking individual stocks carries risk. If one company fails, your income stream takes a hit. For investors who want “set it and forget it” monthly income, ETFs are the superior choice.

JPMorgan Equity Premium Income ETF (JEPI)

JEPI has taken the investing world by storm, gathering billions in assets. Why? Because it solves the biggest problem with high yield: Volatility.

How it works: JEPI holds a basket of low-volatility stocks (like Pepsi, Hershey, Microsoft) and then sells covered calls against them. This options strategy generates cash flow regardless of whether the market goes up or down.

- Current Yield: ~8.17% (Source: Morningstar/JPMorgan Asset Management, Dec 2025)

- The Edge: Morningstar analysts noted that “The fund shines during major downturns,” beating the S&P 500 by over 14 percentage points during the 2022 market meltdown. It offers lower volatility than the broader market with much higher income.

The “Yield Trap” Warning: What to Avoid

I cannot stress this enough: A high yield is often a distress signal. If you see a stock paying 14% or 15% monthly, run the other way.

The Mortgage REIT (mREIT) Risk

Companies like AGNC Investment Corp (AGNC) or Armour Residential (ARR) often appear on “top monthly stock” lists because of double-digit yields. However, these are “Mortgage REITs.” They don’t own buildings; they own paper debt. They are highly sensitive to interest rate fluctuations.

As Investopedia warns in their guide on dividend risks, “A high dividend yield many times signifies financial troubles… the yield is high because the company’s shares have fallen.” AGNC, for example, has seen its stock price erode significantly over the last decade, meaning your high dividend was just your own principal being paid back to you.

The Payout Ratio Mistake (FFO vs. EPS)

Here is a technical secret most blogs won’t tell you. When checking if a REIT like Realty Income is safe, do not use Earnings Per Share (EPS).

By accounting rules, real estate companies must deduct “depreciation” from their earnings. This makes their EPS look artificially low. Instead, you must look at Funds From Operations (FFO). If a REIT pays out 80% of its FFO, it is safe. If it pays out 110% of FFO, the dividend is at risk of being cut.

The Tax Reality: What Nobody Tells You

This section alone can save you thousands of dollars. The IRS treats monthly dividends differently depending on where they come from.

Most dividends from corporations (like Coca-Cola or Apple) are “Qualified Dividends,” taxed at a preferential rate of 0%, 15%, or 20%.

However, REITs (like Realty Income and STAG) and BDCs (like MAIN) generally pay “Non-Qualified” or “Ordinary” dividends.

This means they are taxed at your regular income tax bracket, which can be as high as 37% + state taxes. Strategy: Always try to hold REITs and BDCs in a tax-advantaged account like a Roth IRA to avoid this tax drag.

Case Study: The $10,000 Compounding Experiment

Does monthly compounding actually matter? Let’s look at the numbers. We ran a projection comparing a $10,000 investment in a monthly payer vs. a quarterly payer, assuming a 5% annual yield over 10 years with Dividend Reinvestment (DRIP) turned on.

- Scenario A (Quarterly): Ending Balance = $16,436

- Scenario B (Monthly): Ending Balance = $16,470

The Verdict: The financial difference is small ($34). However, the behavioral difference is massive. Seeing that income hit 12 times a year keeps you motivated to save.

Interactive Dividend Calculator

Use our tool below to estimate your potential monthly income.

Conclusion: Start Your Snowball Today

Building a monthly dividend portfolio isn’t a get-rich-quick scheme; it’s a get-rich-for-sure strategy if you avoid the yield traps. By focusing on quality companies like Realty Income and Main Street Capital, or utilizing ETFs like JEPI, you can create a paycheck that never requires you to punch a time clock.

Here is your summary checklist for 2025:

| Ticker | Type | Best For… |

|---|---|---|

| O | REIT | Maximum Safety & Reliability |

| MAIN | BDC | High Yield & Special Dividends |

| JEPI | ETF | Diversification & Lower Volatility |

| STAG | REIT | E-Commerce Growth Exposure |

Remember, the best time to plant a tree was 20 years ago. The second best time is today. Open your Roth IRA, research these tickers, and start your income snowball.

Frequently Asked Questions (FAQ)

Are monthly dividend stocks safe?

Not all are safe. While “Dividend Aristocrats” like Realty Income (O) have high safety ratings, many monthly payers are high-risk mortgage REITs. Always check the Payout Ratio (using FFO for REITs) before investing. If the payout ratio is under 90%, it is generally considered sustainable.

How much do I need to invest to get $1,000 a month?

This depends on your average yield. If you build a portfolio with a safe average yield of 6%, you would need to invest approximately $200,000 to generate $1,000 in monthly passive income ($12,000 annually).

Are REIT dividends qualified or ordinary income?

The vast majority of REIT dividends are taxed as ordinary income, meaning they are taxed at your marginal income tax rate (up to 37%). This is why it is highly recommended to hold REITs in tax-advantaged accounts like a Roth IRA.