What Are Passive Real Estate Tax Benefits?

(2025 Guide: 100% Bonus Depreciation is Back)

Did you know the “Tax Cliff” that investors were dreading has been officially cancelled? If you’ve been following the news, you might have heard about the signing of the 2025 Tax Reform Act this past July. But what does that legalese actually mean for your portfolio?

In my years of advising high-net-worth clients, I’ve rarely seen a legislative pivot this significant. Just when we thought bonus depreciation was phasing down to oblivion, Congress hit the reset button. The result? Real estate remains, unequivocally, the most tax-advantaged asset class in the United States.

If you are a high-income earner—whether a doctor, lawyer, or business owner—you face a common enemy: the highest marginal tax brackets. You make money, but you don’t keep enough of it. Passive real estate tax benefits are the legal mechanisms that allow you to decouple your income from your tax bill.

This guide isn’t just a definition list; it’s a strategic roadmap. We will break down how to utilize depreciation, navigate the complex “passive loss” rules, and leverage the new 2025 laws to potentially pay near-zero taxes on your rental income.

The “Big Three” Tax Pillars of Real Estate

Before we dive into the complex loopholes, we need to understand the bedrock of real estate taxation. In my experience, most new investors understand cash flow, but they completely underestimate the power of the “Big Three” tax shields.

1. Depreciation: The Phantom Expense

Depreciation is the holy grail of real estate investing. It is a “phantom” expense because it allows you to deduct the cost of the building over time, even though you aren’t actually spending that cash each year. In fact, while you take this deduction, the property is likely appreciating in value.

Typically, residential real estate is depreciated over 27.5 years. However, the game changed in 2025. According to PwC Tax Insights (July 2025), the new legislation permanently restored 100% bonus depreciation for qualified property acquired and placed in service after January 19, 2025. This allows you to deduct the entire cost of eligible assets (like appliances, flooring, and land improvements) in Year 1, rather than waiting decades.

2. Amortization & Operating Expenses

Beyond depreciation, the tax code allows you to deduct the “cost of doing business.” This includes mortgage interest, property taxes, insurance, and even travel expenses related to managing the property.

Don’t overlook the interest deduction. While your principal paydown increases your equity (wealth), the interest portion reduces your taxable income.

3. The Qualified Business Income (QBI) Deduction

Often forgotten, the Section 199A deduction allows eligible pass-through business owners (which includes many rental property owners) to deduct up to 20% of their qualified business income (QBI) from their taxes. This provision was solidified in the recent updates, ensuring that rental income is taxed at a significantly lower effective rate than W-2 wages.

Understanding Passive Activity Loss (PAL) Limitations

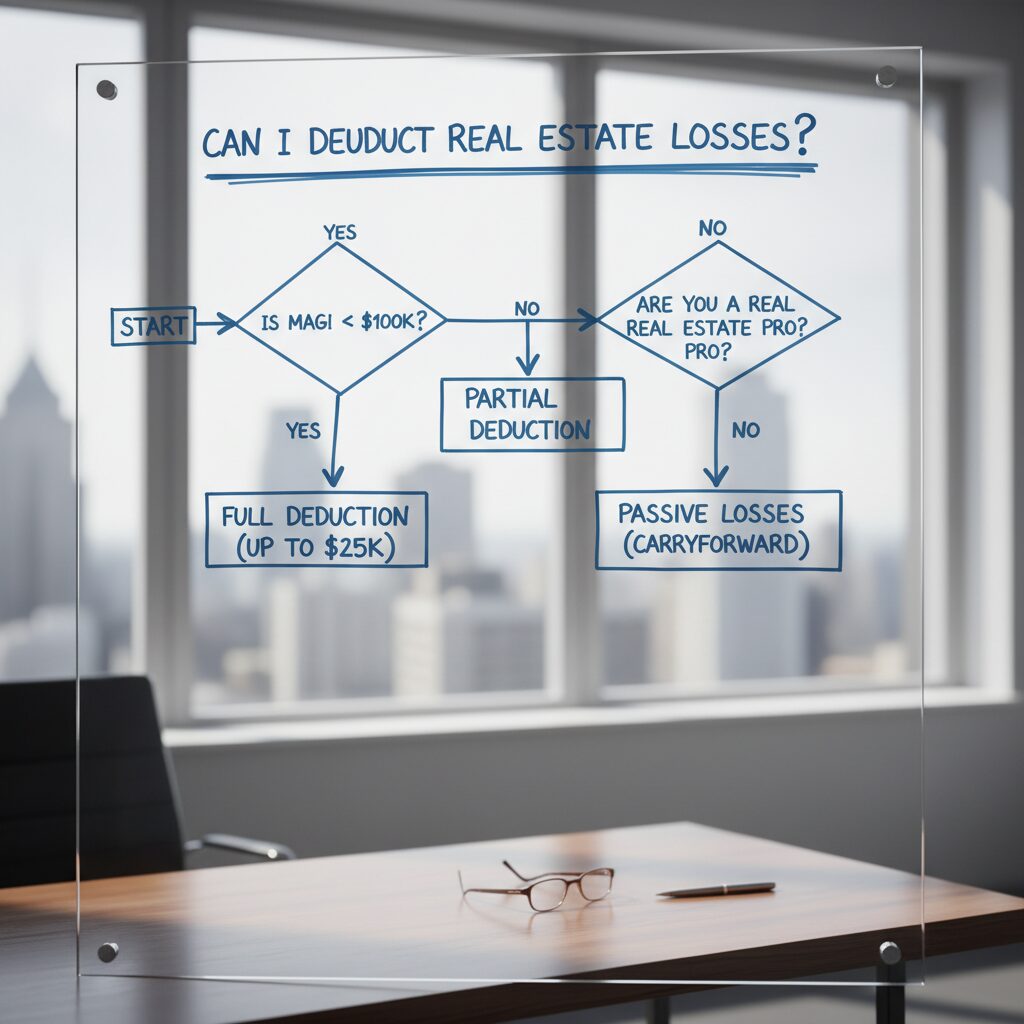

Here is the catch—and it’s a big one. The IRS categorizes income into three buckets: Active (W-2), Portfolio (Stocks), and Passive (Real Estate).

The General Rule (Section 469): Passive losses can only offset passive income. You generally cannot use a “paper loss” from your rental property to lower the taxes on your salary as a surgeon or software engineer. If your rental loses $10,000 on paper but you have no other passive income, that loss is “suspended” and carried forward to future years.

However, there are exceptions. And this is where the wealthy separate themselves from the average investor.

Exception 1: The $25,000 Active Participation Allowance

If you actively participate in your rental activities (i.e., you approve tenants, make management decisions), you can deduct up to $25,000 of passive losses against your active income.

But there is a limit. This allowance begins to phase out once your Modified Adjusted Gross Income (MAGI) hits $100,000 and disappears completely at $150,000. For many of my clients, this phase-out renders the allowance useless, leading us to the more advanced strategies below.

Exception 2: Real Estate Professional Status (REPS)

This is the “Holy Grail” for high-income earners. If you qualify as a Real Estate Professional, your rental losses are treated as non-passive. This means they can offset your high W-2 income directly.

To qualify, you must meet two rigorous tests as outlined in IRS Publication 925 (2025 Edition):

- The 50% Test: More than 50% of your personal services during the year must be performed in real property trades or businesses.

- The 750-Hour Test: You must perform more than 750 hours of services in real property trades or businesses.

Warning: The IRS scrutinizes this heavily. Contemporaneous time logs are non-negotiable. If you have a full-time W-2 job outside of real estate, qualifying for REPS is virtually impossible unless you are a unicorn or your spouse qualifies.

Advanced Strategies for High Earners (2025 Updates)

If you don’t qualify for REPS, don’t worry. The 2025 landscape offers powerful alternatives.

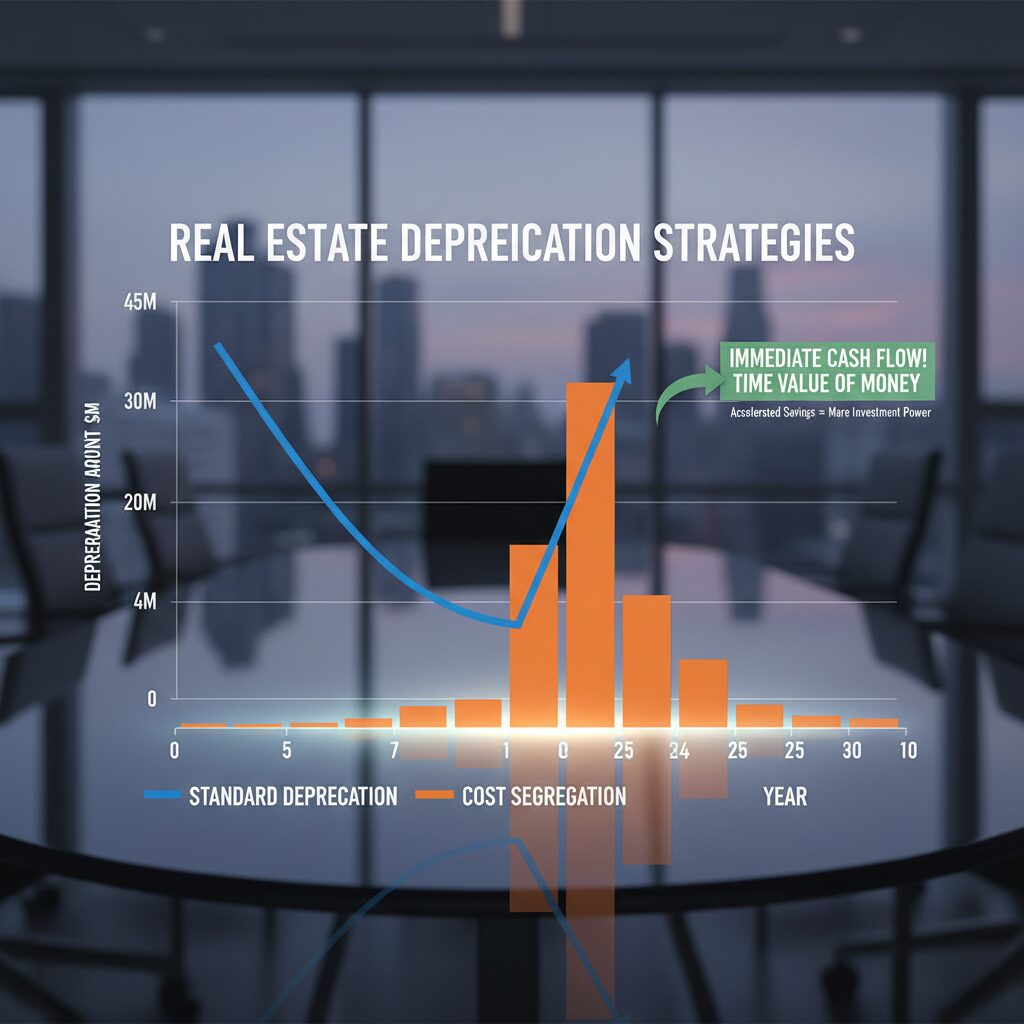

Cost Segregation: The Turbocharger

A Cost Segregation study is an engineering-based analysis that breaks your property down into its components. Instead of depreciating the whole building over 27.5 years, you identify assets (carpet, lighting, landscaping) that can be depreciated over 5, 7, or 15 years.

Thanks to the reinstatement of 100% bonus depreciation, any asset identified with a life of 20 years or less can be fully expensed in the first year. According to KBKG Cost Segregation Insights (Nov 2025), the average first-year tax savings for properties valued over $1M now range from $40,000 to $200,000.

CASE STUDY: The 2025 “Cost Seg” Difference

Scenario: You buy a $1,000,000 multifamily property in February 2025. The building value is $800,000 (excluding land).

Option A (Standard Depreciation):

$800,000 / 27.5 years = $29,090 deduction.

Option B (Cost Segregation + 100% Bonus):

The study identifies 25% of the building ($200,000) as personal property.

1. Immediate Bonus Deduction: $200,000

2. Remaining Depreciation: $21,818

Total Year 1 Deduction: $221,818

Result: At a 37% tax bracket, Option B saves you roughly $82,000 in actual cash taxes in Year 1, compared to just $10,000 with Option A.

The Short-Term Rental (STR) Loophole

This is my favorite strategy for high-earning W-2 professionals who cannot quit their jobs. Under 26 CFR § 1.469-1T, if the average customer stay at your property is 7 days or less, the activity is not defined as a “rental activity” under Section 469.

If you materially participate (e.g., manage the cleaners, handle bookings) for at least 100 hours (and more than anyone else), the losses are treated as active. This allows you to use massive cost segregation losses from an Airbnb to offset your surgeon or CEO salary—without needing Real Estate Professional Status.

Depreciation Calculator (Estimate Only)

2025 Depreciation Estimator

Estimate your potential Year 1 deduction under the new 100% Bonus Depreciation rules.

Deferring Taxes Upon Exit

The benefits don’t stop when you sell. In fact, if you pay capital gains tax on real estate, you likely opted out of the system voluntarily.

1031 Like-Kind Exchanges

The “Swap till you drop” strategy remains intact in 2025. This section of the tax code allows you to sell a property and roll 100% of the proceeds into a new, “like-kind” property, deferring all capital gains taxes.

Opportunity Zones (The 2026 Deadline)

We are approaching the finish line here. Qualified Opportunity Funds (QOF) allow investors to defer capital gains until tax year 2026. With the current simulated date of December 2025, urgent planning is required. If you have substantial capital gains, moving them into a QOF immediately is critical to maximizing the remaining deferral window.

Essential Stats for the 2025 Investor

Maximum Section 179 Expensing Limit for 2025

(Source: IRS Revenue Procedure 2024-40)

Other key figures to keep in mind for your 2025 tax planning:

- Excess Business Loss Limit: RSM Reports that losses are capped at $313,000 for single filers ($626,000 joint) in 2025.

- Capital Gains Threshold: The 20% rate now kicks in at $533,400 for single filers, according to IRS inflation adjustments.

FAQ: Common Real Estate Tax Questions

Has bonus depreciation phased out in 2025?

No. Under the new 2025 Tax Reform Act (P.L. 119-21), 100% bonus depreciation was permanently restored for assets acquired after Jan 19, 2025. Many older articles may still reference the old phase-out schedule, but those rules are now obsolete.

Can I offset my W-2 salary with rental losses?

Generally, no, unless you qualify as a “Real Estate Professional” or use the “Short-Term Rental” strategy (average stay < 7 days) and materially participate in the management of the property.

What is the income limit for the $25,000 rental loss deduction?

The full deduction is available if your Modified Adjusted Gross Income (MAGI) is $100,000 or less. It phases out by 50 cents for every dollar over $100,000 and is completely eliminated once your MAGI reaches $150,000.

Conclusion: Don’t File Your 2025 Return Blind

Real estate is more than just bricks and mortar; it is a sophisticated tax shelter designed to encourage investment. The restoration of 100% bonus depreciation in July 2025 has reopened a window of opportunity that many thought was closed forever.

However, these benefits are not automatic. They require proactive documentation, strategic timing of purchases (cost segregation studies must be done before you file!), and a deep understanding of the passive loss rules.

My advice? Do not rely on a generalist CPA who files returns for retail stores and W-2 employees. Find a tax strategist who specializes in real estate. With the 2025 limits at historic highs, the cost of ignorance has never been more expensive.