10 Best High-Yield Dividend Stocks for Income in 2025 (Safe Picks & Warnings)

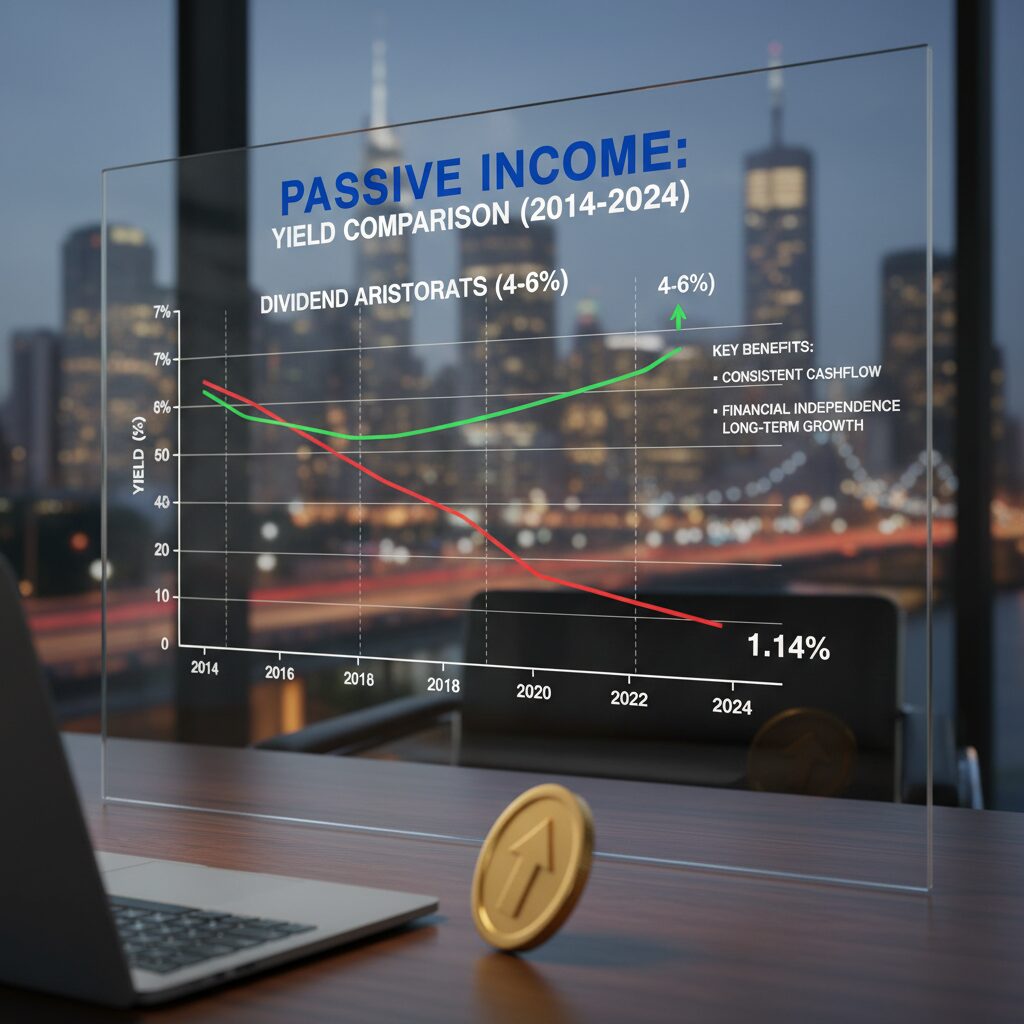

Quick Take: In a market where the average S&P 500 yield has dropped to a multi-decade low of 1.14%, finding “safe” yield is harder than ever. High yield often means high risk—just ask Walgreens investors. Below, we analyze 5 “Forever” income stocks, 3 high-growth dividend ETFs, and expose 2 dangerous “Yield Traps” you must avoid.

We need to talk about the income crisis facing retirees right now.

I recently spoke with a client who was devastated. He had chased a 9% dividend yield in early 2024, thinking he had secured his retirement income. By January 2025, that company—Walgreens—had suspended its dividend entirely. His income stream evaporated overnight, and his capital was down 57%.

This isn’t an isolated incident. In today’s market, the gap between “safe income” and a “yield trap” has never been wider.

If you are looking for the best high-yield dividend stocks for income in late 2025, you have to look beyond the headline number. We are going to break down the safest plays, the turnaround gambles, and the tax strategies you need to survive 2026.

The “Safe Yield” Landscape in Late 2025

Before we dive into specific tickers, let’s set the stage. Why is it so hard to find good income right now?

According to GuruFocus data from December 5, 2025, the S&P 500 dividend yield is hovering between 1.14% and 1.17%. This is historically low. Companies are opting for stock buybacks over cash payouts.

— Dan Lefkovitz, Strategist at Morningstar (Dec 1, 2025)

Morningstar’s analysis suggests we will see $1 Trillion in buybacks versus only $750 Billion in dividends for the 2025 fiscal year. This means as an income investor, you are fighting against the current corporate trend.

CRITICAL WARNING: The “Yield Trap” Checklist

Before buying any stock on this list or elsewhere, run it through this mental checklist. If a stock yields over 8%, ask these questions:

- Is the Payout Ratio > 80%? (Unless it’s a REIT or BDC).

- Is Free Cash Flow (FCF) declining? Dividends are paid from cash, not “adjusted earnings.”

- Is the debt load rising while rates stay high?

Top 5 “Forever” High-Yield Stocks for Reliability

These are the companies you marry, not date. They have survived recessions, inflation, and changing interest rate cycles.

Yield: 5.5%

The Monthly Dividend Company

Why it’s a buy: Realty Income remains the gold standard for retirees who want their investment income to match their monthly bills. As of November 2025, Motley Fool reports a yield of roughly 5.5%.

Realty Income owns over 13,000 properties, mostly leased to recession-resistant tenants like 7-Eleven and Dollar General. It is a classic “sleep well at night” stock. While interest rates in 2025 have pressured the stock price, the dividend integrity remains ironclad.

Yield: >6.5%

The Telecom Cash Cow

Why it’s a buy: Boring is beautiful. Verizon continues to churn out massive cash flow. With a yield exceeding 6.5% as of late 2025, it offers a massive spread over the 10-year Treasury.

The 5G capital expenditure cycle is largely winding down, meaning more free cash flow is available to support the dividend. It’s not a high-growth stock, but for pure income, it is hard to beat.

Yield: 4.5%

Energy Infrastructure Play

Why it’s a buy: Kinder Morgan operates the pipelines that move America’s energy. Unlike exploration companies that depend on the price of oil, KMI operates like a toll booth. They get paid based on volume.

With a 4.5% yield, they have rebuilt their balance sheet significantly over the last five years and are now in a position to slowly grow that payout again.

Yield: 4.4%

International Diversification

Why it’s a buy: You shouldn’t limit your income to the US borders. Canadian banks are historically more regulated and conservative than their American counterparts. BNS offers exposure to Canada and Latin America, providing a solid 4.4% yield that is well-covered by earnings.

Yield: 3.1%

The Growth-Income Hybrid

Why it’s a buy: Sometimes the best dividend stock is one that offers capital appreciation alongside income. At 3.1%, the yield is lower than VZ, but the growth potential is higher. Victory Capital has been aggressively acquiring assets, increasing their AUM (Assets Under Management) and fueling dividend growth.

The “Turnaround” Play (High Risk/High Reward)

Now, let’s look at a controversial pick. This is for the aggressive portion of your portfolio, not your grocery money.

Yield: ~7%

The Surprise Hike of 2025

Medical Properties Trust has been a battleground stock for years. After massive cuts in 2024, many left it for dead. However, on November 18, 2025, Nasdaq reported that MPW declared a 12.5% increase to their dividend to $0.09 per quarter.

— Edward K. Aldag, Jr., CEO of Medical Properties Trust (Nov 18, 2025)

My take: This signal of confidence suggests the worst of the tenant issues (specifically Steward Health Care) may finally be in the rearview mirror. It is risky, but the upside is palpable.

Best Dividend ETFs for Hands-Off Investors

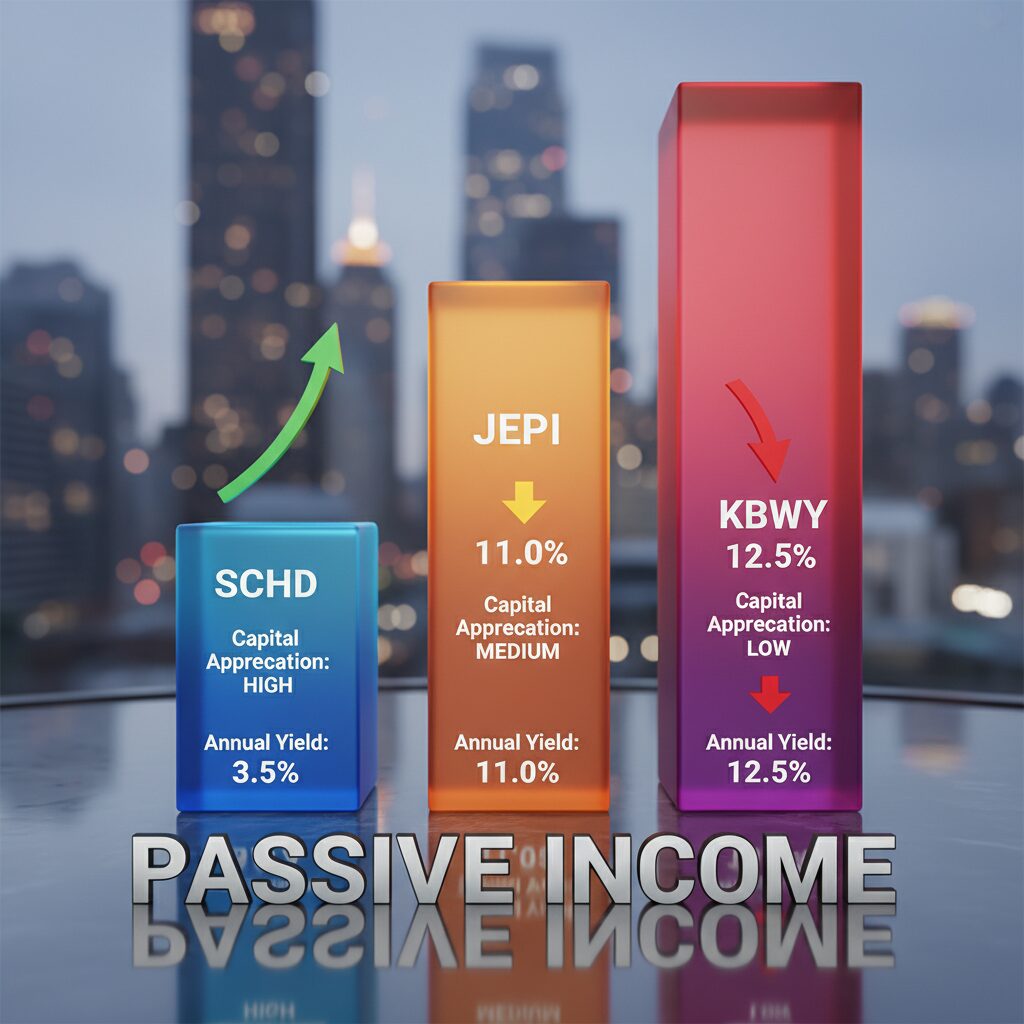

If picking individual stocks feels like too much homework, ETFs are your best friend. Here are the three distinct flavors for 2026.

| ETF Ticker | Strategy | Yield (Est.) | Risk Level |

|---|---|---|---|

| SCHD | Dividend Growth & Quality | 3.8% | Low |

| JEPI | Covered Calls (Income Max) | 7.5% | Medium |

| KBWY | High Yield REITs | 9.9% | High |

Schwab U.S. Dividend Equity ETF (SCHD)

According to 24/7 Wall St (Dec 8, 2025), SCHD is yielding roughly 3.8%. This is the “Goldilocks” ETF. It filters for companies with strong cash flows and a history of raising dividends. If I could only hold one fund for 20 years, this would be it.

JPMorgan Equity Premium Income (JEPI)

JEPI yields around 7.5% by selling call options on its holdings. It performs best in sideways markets. In a year where the market is flat, JEPI will likely outperform the S&P 500 thanks to that monthly coupon.

Case Studies: The Cost of Chasing Yield (Warnings)

I mentioned earlier that high yield can be a trap. Let’s look at the anatomy of two disasters from 2025 so you can spot the warning signs.

1. Walgreens (WBA) – The Dividend Aristocrat that Fell

For decades, Walgreens was a staple in income portfolios. But debt and changing retail habits rotted the core business.

- The Event: After a cut in 2024, WBA suspended its quarterly dividend entirely on Jan 30, 2025 to free up cash.

- The Lesson: Never buy a stock strictly because of its history. If earnings per share (EPS) keeps dropping, the dividend will eventually be cut.

2. Xerox (XRX) – The 90% Haircut

Xerox investors were enjoying a high yield for most of 2025, but the payout ratio was unsustainable.

- The Event: On November 6, 2025, Xerox announced a 90% reduction in its dividend, dropping it to just $0.025 per share.

- The Lesson: When a company announces a major acquisition or restructuring (like Xerox’s move to pay down debt), the dividend is often the first casualty.

As Keytrade Bank analysts noted in their updated 2025 report: “Just like a shiny apple may be hiding a worm, high dividend yields may be a sign of underlying problems… A dividend yield of 5% to 6% is a healthy high end. Above that, the risk regarding shelf life increases sharply.”

Tax Strategy for Dividend Investors (2025-2026)

It’s not just about what you make; it’s about what you keep. For the 2025 tax year (which you file in 2026), knowing the “Qualified Dividend” brackets is essential.

According to IRS Rev. Proc. 2024-40, here are the numbers that matter:

| Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly |

|---|---|---|

| 0% | Up to $48,350 | Up to $96,700 |

| 15% | $48,351 to $533,400 | $96,701 to $600,050 |

| 20% | Over $533,400 | Over $600,050 |

The 60-Day Rule: To get these lower tax rates (instead of your regular income tax rate), you must hold the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date. Do not day-trade your dividend stocks!

FAQ: Your Income Investing Questions Answered

What is a good dividend yield in 2025?

With the S&P 500 yielding ~1.14%, a “good” but safe yield is generally between 3% and 5%. Anything above 7% requires deep due diligence regarding the company’s debt and cash flow.

Are high-yield dividends safe?

Not inherently. High yield is often a result of a dropping stock price. Always check the payout ratio. If a company pays out more than 100% of its earnings (like Xerox did before its cut), the dividend is unsafe.

Which S&P 500 stock pays the highest dividend?

While this changes daily with price fluctuations, stocks like Altria (MO) and Verizon (VZ) consistently rank at the top of the S&P 500 yield list, often ranging between 6% and 9%.

Final Thoughts

Building a passive income stream in late 2025 requires more vigilance than before. The easy money is gone, and the gap between winners (like Realty Income) and losers (like Walgreens) is widening.

Focus on Cash Flow over Yield. A 3.8% yield from SCHD that grows every year will serve your retirement far better than a shaky 9% yield that gets cut to zero.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. I am a writer, not a financial advisor. Always do your own research or consult a certified professional before investing.