How to Invest $2,000 in Dividend Stocks: The 2025 “Snowball” Strategy

Turn a modest starting balance into a recurring income engine using fractional shares and tax-advantaged accounts.

Let’s be brutally honest for a second: investing $2,000 isn’t going to let you quit your job tomorrow. If anyone tells you otherwise, run. But here is the thing—in the current 2025 financial landscape, $2,000 is the perfect “Goldilocks” amount to ignite a dividend snowball that rolls automatically.

You might be wondering, “Is it even worth the effort for a few dollars a month?”

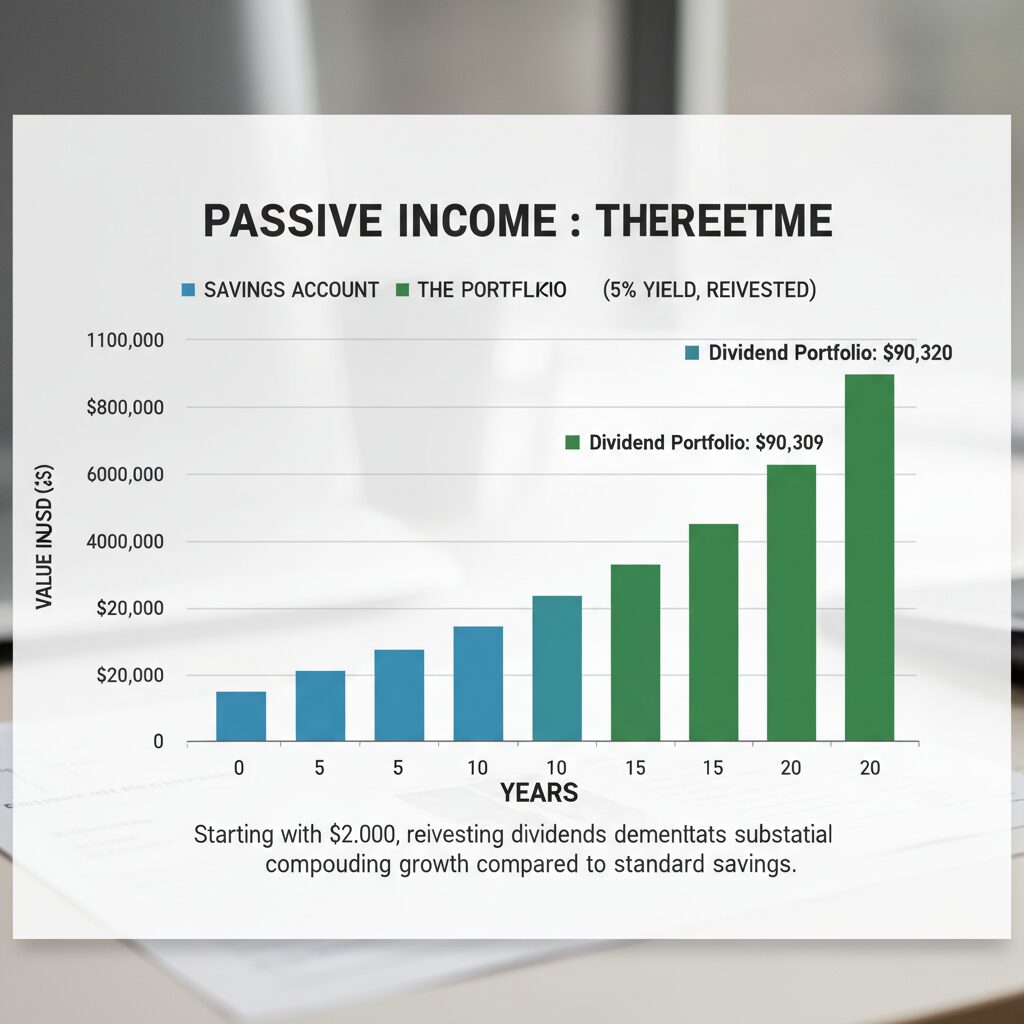

I’ve seen portfolios start with less than $500 turn into substantial safety nets over a decade, not because of luck, but because of math. The difference between saving $2,000 and investing it is the difference between a stagnant pond and a flowing river.

In this guide, we are moving beyond generic “buy low, sell high” advice. We are going to build three specific, actionable portfolio models you can copy today using fractional shares, backed by the latest 2025 tax data and market realities.

The Reality Check: What $2,000 Actually Earns

Before we deploy your capital, we need to manage expectations. In my years of analyzing market data, I’ve found that new investors often chase dangerous yields (10%+) and get burned. Sustainable dividend investing is about the balance between yield (cash now) and growth (cash later).

According to data from late 2024, the S&P 500 dividend yield is hovering near historical lows. Specifically, GuruFocus data tracks the S&P 500 yield at approximately 1.14%. If you dumped your $2,000 into a standard index fund, you’d only see about $22 in income for the entire year.

However, that’s not our only option. Equity Real Estate Investment Trusts (REITs) are telling a different story. According to NAREIT’s November 2024 market snapshot, equity REITs are offering an average dividend yield of 3.92%.

If you achieve a total return of 8% (growth + dividends), your $2,000 will double to $4,000 in roughly 9 years without you adding another penny. If you leave it in a 0.01% checking account, it would take 7,200 years to double.

We are going to aim for a “blended” yield of roughly 3.5% to 4.5%, with a focus on companies that raise their payouts every year.

The “Secret Weapon” for Small Accounts: Fractional Shares & DRIP

Ten years ago, buying a diversified portfolio with $2,000 was impossible. If a stock cost $400, you could buy five shares, and that was it. You were concentrated and risky.

Today, the game has changed entirely thanks to Fractional Shares. This is the mechanism that makes our $2,000 strategy viable. Brokerages like Fidelity and Charles Schwab now allow you to buy “slices” of stocks and ETFs for as little as $5. This means your $2,000 can be spread across 20 different high-quality companies, instantly giving you the diversification of a millionaire.

Automating Wealth with DRIP

The second part of this engine is the DRIP (Dividend Reinvestment Plan). When Coca-Cola pays you a dividend of $5.00, you don’t take the cash. You automatically use it to buy $5.00 worth of more stock.

It sounds small, but this is how the snowball forms. You aren’t just earning interest on your principal; you are earning interest on your interest.

3 Ways to Allocate Your $2,000 (The Core Strategy)

I have designed three distinct portfolio models based on your personal risk tolerance and involvement level. You don’t need to overthink this—pick the one that lets you sleep at night.

Option A: The “Sleep Well” (100% ETF Strategy)

Best for: Beginners who want total passivity and maximum safety.

Instead of picking winners, you buy the whole basket. For this model, we look at the Schwab U.S. Dividend Equity ETF (SCHD).

Why SCHD? According to the Schwab Asset Management Fact Sheet (Q3 2024), this fund has delivered a 10-year annualized return (CAGR) of approximately 11-12% with dividends reinvested. It filters for companies with a history of paying dividends, providing a quality screen you can’t replicate easily on your own.

- Allocation: $2,000 into SCHD (or VYM – Vanguard High Dividend Yield).

- Est. Yield: ~3.4%

- Annual Income: ~$68 (automatically reinvested).

Option B: The “Monthly Paycheck” (Income Focus)

Best for: Investors who want to see cash hit their account every 30 days.

Most companies pay quarterly. However, some pay monthly, which aligns perfectly with your bills. For this, we look at high-quality Business Development Companies (BDCs) and REITs.

The Assets:

- Realty Income (O): Often called “The Monthly Dividend Company,” they own thousands of commercial properties (like 7-Eleven and Walgreens).

- Main Street Capital (MAIN): A top-tier BDC that lends to medium-sized businesses.

Strategy: Split your $2,000 evenly ($1,000 in O, $1,000 in MAIN).

Option C: The “Dividend King” (Quality Split)

Best for: Investors who want to own specific, world-class brands.

A “Dividend King” is a company that has increased its dividend for 50+ consecutive years. These companies have survived inflation, recessions, and pandemics. We will use fractional shares to split your $2,000 into four $500 slices.

| Company | Sector | Why It Works |

|---|---|---|

| Procter & Gamble (PG) | Consumer Staples | People buy toothpaste in recessions. |

| Johnson & Johnson (JNJ) | Healthcare | AAA credit rating (higher than the US Gov). |

| Coca-Cola (KO) | Beverages | Unmatched global distribution network. |

| Lowe’s (LOW) | Home Improvement | High dividend growth rate. |

Maximizing Your Returns: The 2025 Tax Advantage

Here is where most beginners mess up: Taxes. Dividends are taxable events. If you hold these stocks in a standard brokerage account, Uncle Sam takes a cut every time you get paid, dragging down your compounding speed.

The solution? The Roth IRA.

In a Roth IRA, you contribute after-tax money, but your investments grow tax-free, and you can withdraw them tax-free in retirement. According to the IRS, the annual contribution limit for 2025 remains $7,000 for those under 50.

Pro Tip: Asset Location

If you choose Portfolio B (REITs), you almost must use a Roth IRA. Why? Because REIT dividends are usually taxed as “ordinary income” (up to 37%), whereas qualified dividends (like Coca-Cola) are taxed at lower capital gains rates (0%, 15%, or 20%).

According to IRS Revenue Procedure 2024-40, single filers pay 0% tax on qualified dividends if their taxable income is below roughly $48,350 in 2025. Know your bracket!

Project Your Growth (Interactive)

Use this simple calculator to see how your $2,000 can grow if you continue to add to it monthly.

Dividend Snowball Calculator

4 Risks to Watch Before You Buy

I would be doing you a disservice if I didn’t address the risks. Even “safe” dividend stocks have pitfalls.

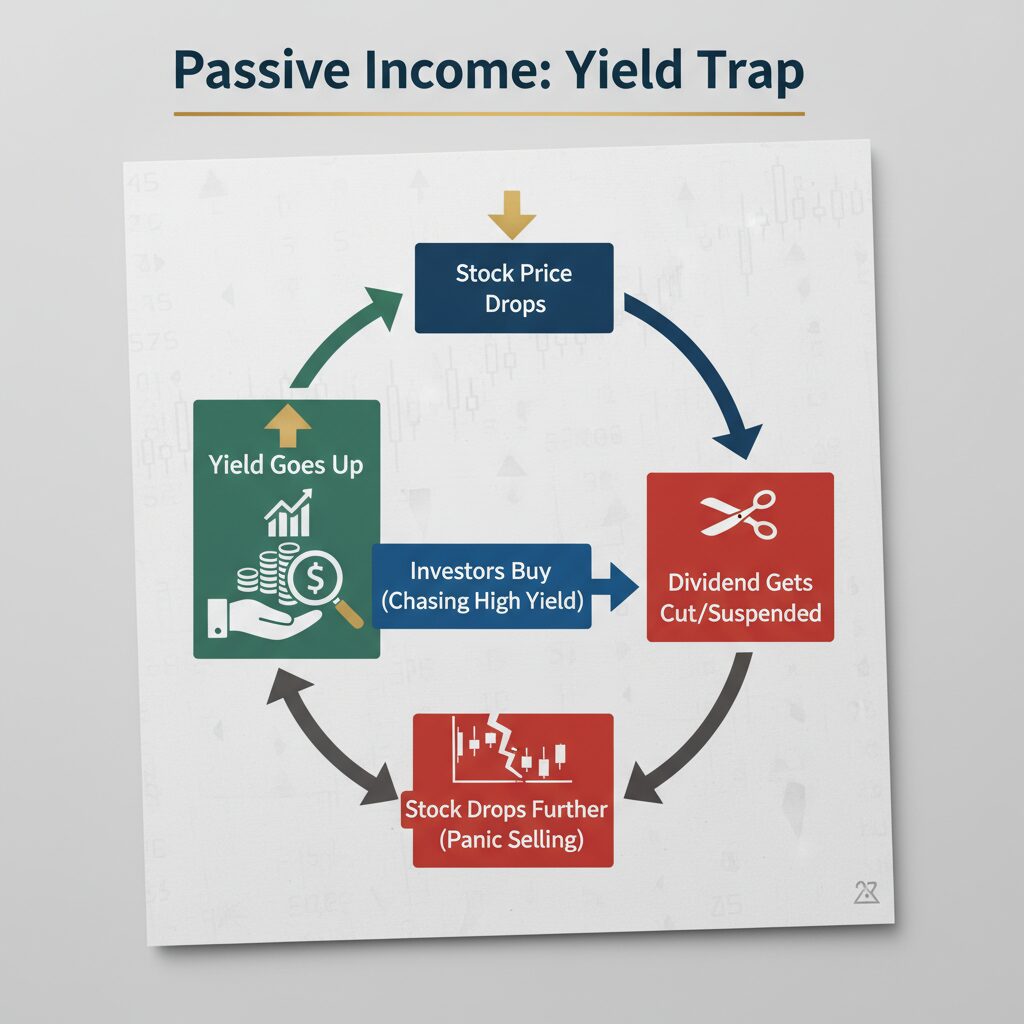

1. The “Yield Trap”

If you see a stock paying 12% or 15%, be extremely skeptical. Often, the yield is high only because the stock price has crashed due to underlying business failures. A cut dividend usually follows a price crash.

2. Interest Rate Sensitivity

Dividend stocks, especially utilities and REITs, compete with bonds. When interest rates stay high, conservative investors flock to Treasuries instead of stocks. In a December 2024 interview with CNBC, Wharton Professor Jeremy Siegel noted that while the S&P might see moderate returns, value stocks are poised to wake from their lethargy—but only if rates stabilize.

3. The Retirement Crisis Context

Why is this necessary? Because relying on social safety nets is becoming riskier. Larry Fink, Chairman of BlackRock, stated in his 2024 Annual Letter that the capital markets will be key to addressing the “retirement crisis.” By investing your $2,000 now, you are taking personal responsibility for your financial sovereignty.

FAQ: Common Questions on Small Account Investing

Can I lose my $2,000?

Yes. Investing in the stock market carries principal risk. However, by using broad ETFs (Portfolio A) or Dividend Kings (Portfolio C), you are betting on the long-term profitability of the American economy, which has a 100% track record of recovering from downturns over 20-year periods.

How much will I make per month?

Initially, a $2,000 portfolio yielding 4% generates about $80 per year, or roughly $6.60 per month. It sounds small, but remember: you didn’t have to work for it.

Do I have to pay taxes on reinvested dividends?

If you are in a standard brokerage account: Yes. Even if you never touched the cash, the IRS counts it as income. This is why the Roth IRA is superior for this strategy.

Conclusion

The best time to plant a tree was 20 years ago. The second best time is today. Investing $2,000 in dividend stocks won’t make you a millionaire overnight, but it establishes the habit and the infrastructure for wealth.

Whether you choose the “Sleep Well” ETF route or the “Monthly Paycheck” REIT strategy, the most critical step is to execute. Open the account, fund the $2,000, and click buy. Let the law of compounding interest take over from there.