Can REITs Give Passive Income Monthly? (The 2025 Guide)

Imagine being a landlord who collects rent checks every 30 days but never has to fix a leaking toilet, evict a tenant, or argue with a contractor. That is the promise of Real Estate Investment Trusts (REITs).

In my years of analyzing financial markets, I’ve noticed a recurring frustration among income investors: the “lumpy” cash flow problem. Most dividend stocks pay quarterly. Your bills, however—mortgage, utilities, streaming services—are due monthly. This mismatch creates budgeting friction.

The solution lies in the massive U.S. REIT market. According to late 2024 data from the Nareit Industry Financial Snapshot, U.S. public REITs now own approximately $2.5 trillion in gross assets, with an equity market capitalization of over $1.4 trillion. This isn’t a niche corner of the market; it’s a bedrock asset class.

But can you really rely on them for a monthly paycheck? And more importantly, is it safe?

In this guide, we will move beyond basic lists. We will dissect the mechanics of monthly income, reveal the “tax drag” most influencers hide, and give you the safety metrics you need to survive the 2025 economic landscape.

The “Pure Play” Method: REITs That Pay Monthly

The simplest way to get monthly income is to buy companies that have structured their distribution schedules to align with your calendar. While the majority of the All Equity REITs pay quarterly, a select group of “monthly payers” exists.

However, you must be careful. I’ve seen too many investors pour money into a stock solely because it pays monthly, only to watch the share price collapse. Quality must always trump frequency.

1. Realty Income Corp (The Gold Standard)

You cannot discuss monthly dividends without starting here. Realty Income (Ticker: O) has literally trademarked the phrase “The Monthly Dividend Company®.”

This isn’t just marketing fluff. According to their Investor Relations data, Realty Income has declared over 660 consecutive monthly common stock dividends throughout its 55-year operating history. As of early 2025, they have increased that dividend more than 120 times since their public listing in 1994.

Why it works: They focus on triple-net leases with investment-grade tenants (like Walgreens, 7-Eleven, and Dollar General). This provides cash flow stability that allows for that monthly cadence.

2. STAG Industrial (STAG)

While Realty Income focuses on retail, STAG Industrial focuses on the backbone of the American economy: warehouses and distribution centers. With the continued dominance of e-commerce, STAG’s monthly dividend is supported by the logistics that power our online shopping habits.

3. Agree Realty (ADC)

Another retail-focused REIT, Agree Realty has gained a reputation for a fortress balance sheet and a portfolio heavily weighted toward essential retailers—companies that tend to stay open even during recessions.

The “Staggered” Strategy: Creating Synthetic Monthly Income

Here is the strategy that separates the novices from the pros. The limitation of the “Pure Play” method is that you are restricted to a very small pool of companies. You might miss out on the best-in-class operators like Prologis (PLD) or American Tower (AMT) simply because they pay quarterly.

In my opinion, the “Staggered Dividend Strategy” is superior because it allows you to own higher-quality assets while still getting a check every month. It works by purchasing three different stocks with different payout schedules.

How to Construct the Portfolio

Most quarterly payers follow one of three schedules. By owning one stock from each “slot,” you fill every month of the calendar.

| Schedule Slot | Payout Months | Example Blue-Chip REIT |

|---|---|---|

| Group A | January, April, July, October | Prologis (PLD) – Industrial |

| Group B | February, May, August, November | American Tower (AMT) – Cell Towers |

| Group C | March, June, September, December | Digital Realty (DLR) – Data Centers |

The Result: By holding equal amounts of these three companies, you receive a dividend payment 12 times a year. More importantly, you have diversified across Industrial, Telecommunications, and Data Center sectors.

As noted in a market outlook by Cohen & Steers, “While listed REITs are often viewed as a singular asset class, it is actually a collection of 18 different subsectors that behave differently. Diversification across these sectors is key to stable monthly income.”

Using the staggered strategy forces you to diversify, naturally protecting your income stream against sector-specific downturns.

Critical Safety Checks: FFO vs. EPS

If you take nothing else from this article, let it be this: Do not use Earnings Per Share (EPS) to value a REIT.

I’ve seen countless investors look at a REIT’s P/E ratio, see a high number, and assume the stock is expensive or the dividend is unsafe. This is a fundamental misunderstanding of real estate accounting.

The Depreciation Distortion

In standard accounting, real estate assets must be “depreciated” (written down in value) every year. This reduces Net Income and EPS on paper. However, well-located real estate usually appreciates in value over time.

To fix this, the industry uses a metric called Funds From Operations (FFO). FFO adds that depreciation back into the earnings number to show the true cash flow.

By law, REITs must distribute at least 90% of their taxable income to shareholders annually to maintain their tax-advantaged status. Source: U.S. Securities and Exchange Commission (SEC).

The Safety Rule of Thumb

When analyzing if a monthly dividend is safe, look at the FFO Payout Ratio.

Formula: (Annual Dividend / Funds From Operations)

- Under 70%: Very Safe (Room for growth).

- 70% – 90%: Standard range for quality REITs.

- Over 90%: Danger Zone (High risk of a dividend cut).

The Tax Reality: What You Keep vs. What You Make

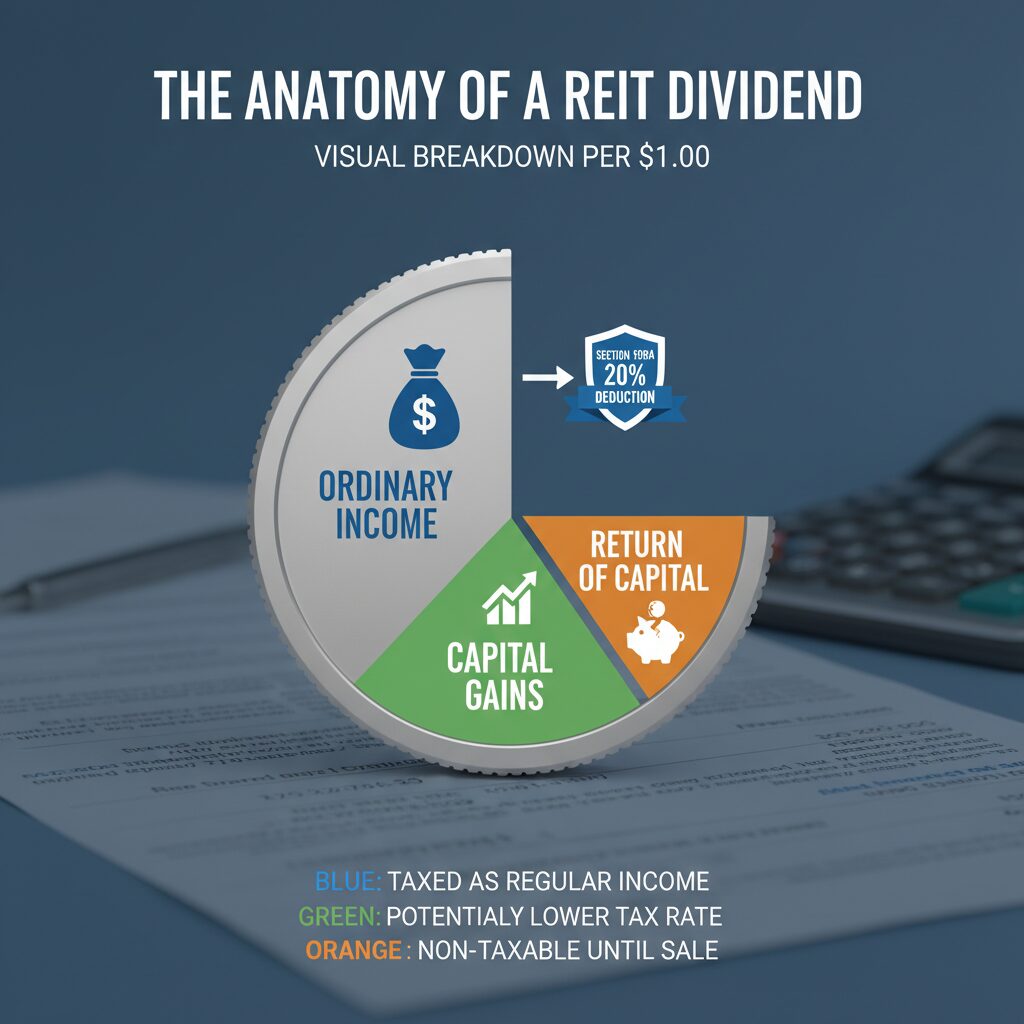

This is the topic most “passive income” gurus skip because it’s boring. But it affects your wallet directly. Unlike Coca-Cola or Apple dividends, which are often taxed at the lower “qualified dividend” capital gains rate (0%, 15%, or 20%), REIT dividends are generally taxed as ordinary income.

This means your REIT income is taxed at your highest marginal bracket—up to 37% for high earners.

The Section 199A Deduction (The Silver Lining)

There is good news. Under the Tax Cuts and Jobs Act (currently effective through 2025), REIT shareholders are generally eligible for a 20% tax deduction on qualified REIT dividends. This is known as the Section 199A deduction.

According to Nareit Tax Guidance, this deduction effectively lowers the top tax rate on REIT dividends. For example, if you are in the 32% bracket, the 20% deduction might lower your effective tax rate on that income significantly, though you should always consult a CPA.

Strategy: Location Matters

Because of this “tax drag,” I always advise clients to hold REITs in tax-advantaged accounts if possible:

- Roth IRA: The Holy Grail. Dividends grow tax-free and are withdrawn tax-free.

- Traditional IRA/401(k): Taxes are deferred until retirement.

- Taxable Brokerage: Only recommended if you’ve maxed out the above or need the income immediately.

Investment Calculator: Requirements for $1,000/Month

How much capital do you actually need to quit your job? Let’s look at the math. According to Nareit REITWatch data, the average dividend yield for All Equity REITs sits between 3.8% and 4.0% as of late 2024.

Passive Income Yield Calculator

As you can see, generating substantial monthly income requires significant capital. However, unlike a rental property, you can start with as little as $50 (or less with fractional shares) and compound your way up using a Dividend Reinvestment Plan (DRIP).

Risks to Watch in 2025

Passive income is never risk-free. If you are entering the REIT market now, you must be aware of the macroeconomic environment.

1. Interest Rate Sensitivity

REITs often behave like bonds. When interest rates rise, REIT share prices tend to fall, and vice versa. Why? Because REITs rely on debt to buy properties. Higher rates mean higher borrowing costs, which eats into FFO. However, Nareit Fundamental Analysis suggests that REITs provide natural protection against inflation, as real estate rents and values tend to increase when prices do.

2. Sector Risk

Not all real estate is equal. In 2024 and 2025, Office REITs have struggled with high vacancy rates due to the work-from-home shift. Meanwhile, Data Center REITs have boomed due to AI demand. Diversification isn’t just a buzzword; it’s a survival tactic.

FAQ: Monthly REIT Income

Are monthly paying REITs safe?

Payment frequency does not determine safety. A monthly paying REIT is only safe if its Affiliated Funds From Operations (AFFO) covers the dividend comfortably. Companies like Realty Income (O) have a high safety rating, while others with payout ratios over 100% are risky regardless of their schedule.

Do REITs pay dividends during a recession?

Generally, yes. REITs are required by the SEC to payout 90% of taxable income. However, during severe recessions (like 2008 or 2020), some REITs may cut or suspend dividends to preserve cash. Essential sectors like healthcare and grocery-anchored retail tend to be more resilient during economic downturns.

How are REIT dividends taxed in 2025?

Most REIT dividends are taxed as ordinary income, not capital gains. However, under the Tax Cuts and Jobs Act, investors can typically deduct 20% of their qualified REIT dividends (Section 199A deduction), effectively lowering the tax burden.

Conclusion: Building Your Passive Income Empire

So, can REITs give you passive income monthly? Absolutely. Whether you choose the “Pure Play” route with reliable stalwarts like Realty Income or construct a “Staggered Portfolio” of blue-chip quarterly payers, the mechanism exists to replace your paycheck with dividend checks.

However, the difference between a successful income investor and a bag-holder lies in due diligence. Don’t just look at the yield. Look at the FFO payout ratio. Look at the tenant quality. And understand the tax implications.

Real estate has been the greatest wealth creator in history. Through REITs, you can access that wealth creation without ever answering a tenant’s phone call. Start small, reinvest your dividends, and let the power of compounding build your monthly income stream.

Disclaimer: I am a financial content writer, not a financial advisor. The information provided here is for educational purposes only. Market data is based on late 2024/early 2025 reporting. Always consult with a qualified financial advisor or tax professional before making investment decisions.