Low Cost Real Estate Passive Income: 7 Verified Strategies for 2025

You no longer need $50,000 for a down payment. Discover the data-backed roadmap to building wealth with under $100.

I still remember the frustration of reading real estate advice a decade ago. Every “expert” suggested the same thing: “Just buy a duplex and rent out the other half.” That’s great advice, assuming you have $50,000 sitting in a savings account for a down payment and closing costs. For most of us, that barrier to entry made real estate feel like an exclusive club with a “members only” sign on the door.

But here is the thing: the landscape has fundamentally shifted. In 2025, the barrier to entry for real estate investing has crashed from $50,000 to under $100.

We are witnessing a “micro-investing” revolution, fueled by fractional ownership and blockchain tokenization. It’s not just hype—the data backs it up. According to a 2025 report from Research and Markets, the real estate crowdfunding market is projected to explode from roughly $20 billion in 2024 to over $122 billion by 2029. That is a massive wave of capital moving into accessible, low-cost assets.

In this guide, I’m not going to give you generic advice about saving for a deposit. Instead, we’re going to look at seven specific, data-verified strategies to generate low cost real estate passive income right now, categorized by how much money you have to start: from $10 to $5,000.

The “Micro-Investing” Revolution ($10 – $500 Entry)

If you have less than $500, you are actually in a sweet spot for liquidity and diversification. You don’t need to deal with tenants, toilets, or trash. You simply own a slice of the pie.

1. Publicly Traded REITs (The Liquid Option)

Real Estate Investment Trusts (REITs) are companies that own or finance income-producing real estate. Think of them like the “mutual funds” of the property world. By law, they must distribute at least 90% of their taxable income to shareholders as dividends.

Why start here? Because they are the easiest entry point. You can buy a share of a REIT for the price of a sandwich.

Many investors worry about volatility, but recent data shows resilience. According to Nareit (National Association of Real Estate Investment Trusts), REITs ended 2024 up 4.9% in total returns, recovering significantly after a dip in late 2023. Specifically, Data Center REITs led the pack with massive 25.2% returns.

For passive income seekers, I recommend looking at “Dividend Aristocrats” like Realty Income (Ticker: O). Often called “The Monthly Dividend Company,” Realty Income offered a roughly ~6% dividend yield entering 2025, according to data from Nasdaq and S&P Global Market Intelligence. Even though their share price dipped in 2024, that actually allows you to lock in a higher yield on cost right now.

Pros: Highly liquid (sell anytime), regulated, consistent dividends.

Cons: correlated with stock market volatility.

2. Fractional Ownership Platforms (The “Landlord Lite” Model)

This is where technology really changes the game. Platforms like Arrived Homes and Lofty allow you to buy shares of specific rental properties. You aren’t buying a generic fund; you are buying “1% of 123 Maple Street.”

You might be wondering, “Does this actually make money?”

Let’s look at the numbers. According to Arrived Homes official data, their Single Family Residential Fund returned 5.14% over the 12-month period ending October 2025. While that is a solid, stable return, you need to compare platforms.

A competitor, Roots Real Estate, utilizes a unique “Commerce-Conscious” model where residents also build wealth. In my analysis of their performance report, Invest With Roots delivered a stunning 12.04% return over the same period ending Oct 2025. This highlights why due diligence matters—not all fractional platforms are created equal.

The “Tokenization” Twist: We are also seeing a shift toward blockchain. According to Lofty.ai, real estate tokenization is expected to grow from $3.5 billion in 2024 to $19.4 billion by 2033. This isn’t just a buzzword; it allows for instant payouts and 24/7 trading of property shares.

The “Growth” Tier ($500 – $5,000 Entry)

If you have a bit more capital, you can enter the world of private equity and debt investing. These strategies often require your money to be “locked up” for longer periods (illiquid), but they aim to outperform the public market.

3. Real Estate Crowdfunding (eREITs)

Crowdfunding platforms pool money from thousands of investors to fund large commercial projects—apartment complexes, industrial parks, or housing developments. Fundrise is the giant in this space.

I’ve tracked Fundrise for years, and transparency is their strong suit. While 2023 was rough for real estate valuations globally, 2024 showed a pivot.

According to Fundrise’s official performance data released in Jan 2025, the platform reported a 5.75% average annual return for 2024. This marks a significant recovery from the -7.45% dip seen in 2023, signaling that valuations have bottomed out and are climbing again.

This is a classic “buy low” scenario. Entering these funds when valuations are depressed allows you to ride the appreciation wave as the market normalizes.

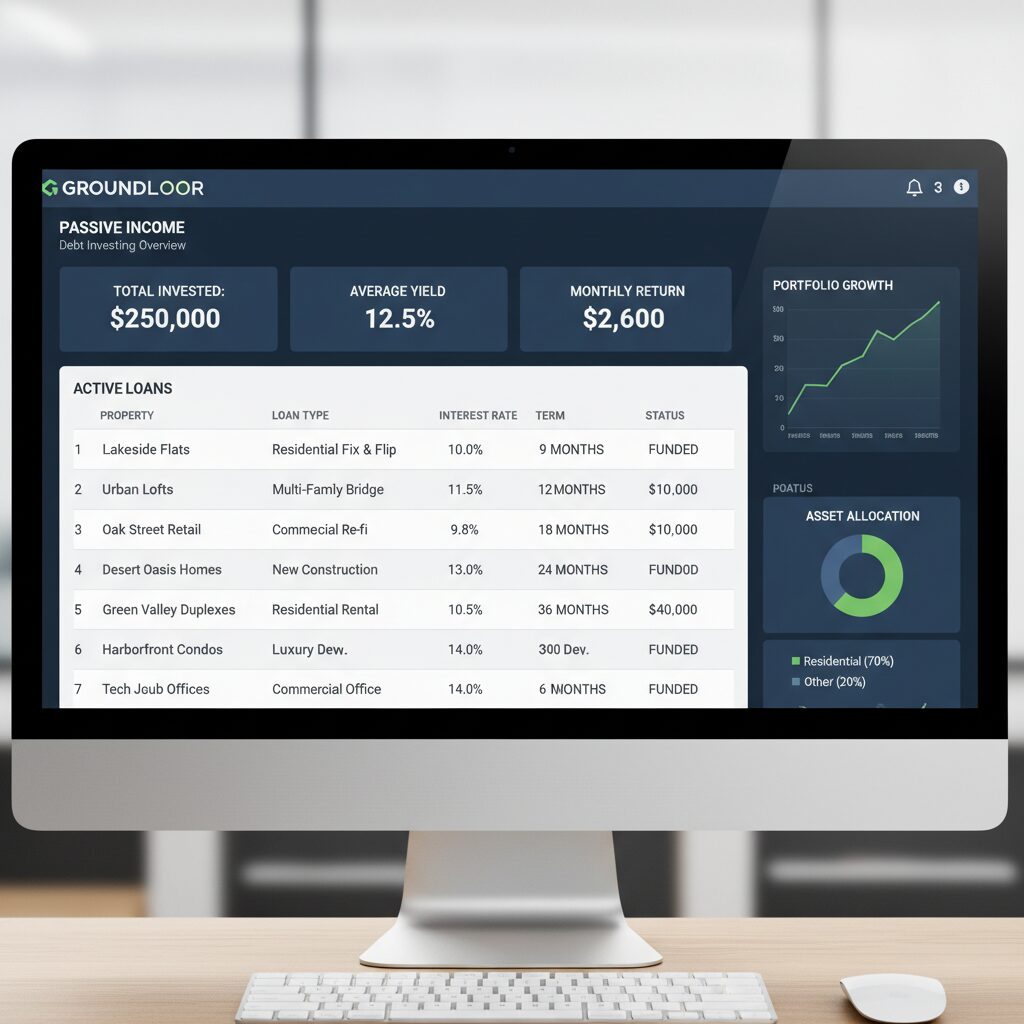

4. Real Estate Debt Investing (Be the Bank)

Most people think investing means owning the building. But owning the debt is often safer. Platforms like Groundfloor allow you to fund short-term renovation loans for house flippers. You aren’t betting on the house value skyrocketing; you’re just betting the flipper will pay you back with interest.

These are typically short-term notes (6-12 months) paying 8-10% interest. The risk? Default. However, because the loan is backed by the physical asset, you have collateral. It’s a compelling way to generate passive income without a 5-year commitment.

The “Creative Ownership” Tier ($5,000+ Entry)

If you have managed to save $5,000 or more, you can start looking at strategies that involve more direct control. This isn’t fully passive initially, but the long-term yields are often superior.

5. High-Yield Location Arbitrage

Here is a strategy most blogs miss: buying cheap rentals in specific high-yield zip codes. You don’t need to buy in New York or Los Angeles. In fact, you shouldn’t.

The average annual gross rental yield for 3-bedroom homes in the US was projected at 7.55% for 2024, according to ATTOM Data Solutions’ Q1 2024 Single-Family Rental Market Report. But averages can be misleading.

If you want to maximize passive income, you need to look at the outliers. The same ATTOM report highlights that Indian River County, FL and St. Louis City, MO offered the highest rental yields in 2024, hitting a massive 14.6%. With $5,000, you could potentially fund a down payment on a low-cost property in the Midwest or partner with a local investor in these specific high-yield zones.

“But that wasn’t enough to make home prices affordable for most workers, which likely fed enough demand to push up rents and yields for investors who lease out single-family properties.”

— Rob Barber, CEO at ATTOM Data Solutions (March 14, 2024)

6. House Hacking & ADUs

If you already own a home, building an Accessory Dwelling Unit (ADU) or renting out a room is the ultimate low-cost entry because you are leveraging an asset you already have.

In 2025, many municipalities have relaxed zoning laws to encourage ADUs. By converting a garage or basement for $5,000 – $15,000 (DIY heavy), you create a permanent income stream that directly offsets your mortgage. It’s not glamorous, but it is the most tax-efficient form of real estate income available.

2025 Market Trends: Why “Low Cost” is Winning

Why is now the right time to jump in? Two major macroeconomic factors are playing into the hands of the low-cost investor.

- Interest Rate Normalization: As interest rates stabilize or undergo cuts in 2025, the cost of borrowing decreases. This typically boosts real estate values. However, REITs often react before the physical market. As yields on savings accounts drop, investors flock to the high dividends of REITs, pushing their prices up.

- Supply and Demand Shifts: In a post-webinar analysis from Jan 24, 2025, the Nareit Research Team noted, “Looking forward to 2025, 2026, and 2027, we see a much more favorable supply/demand picture.” Construction has slowed down, meaning existing assets are becoming more valuable.

Risk Analysis & Due Diligence

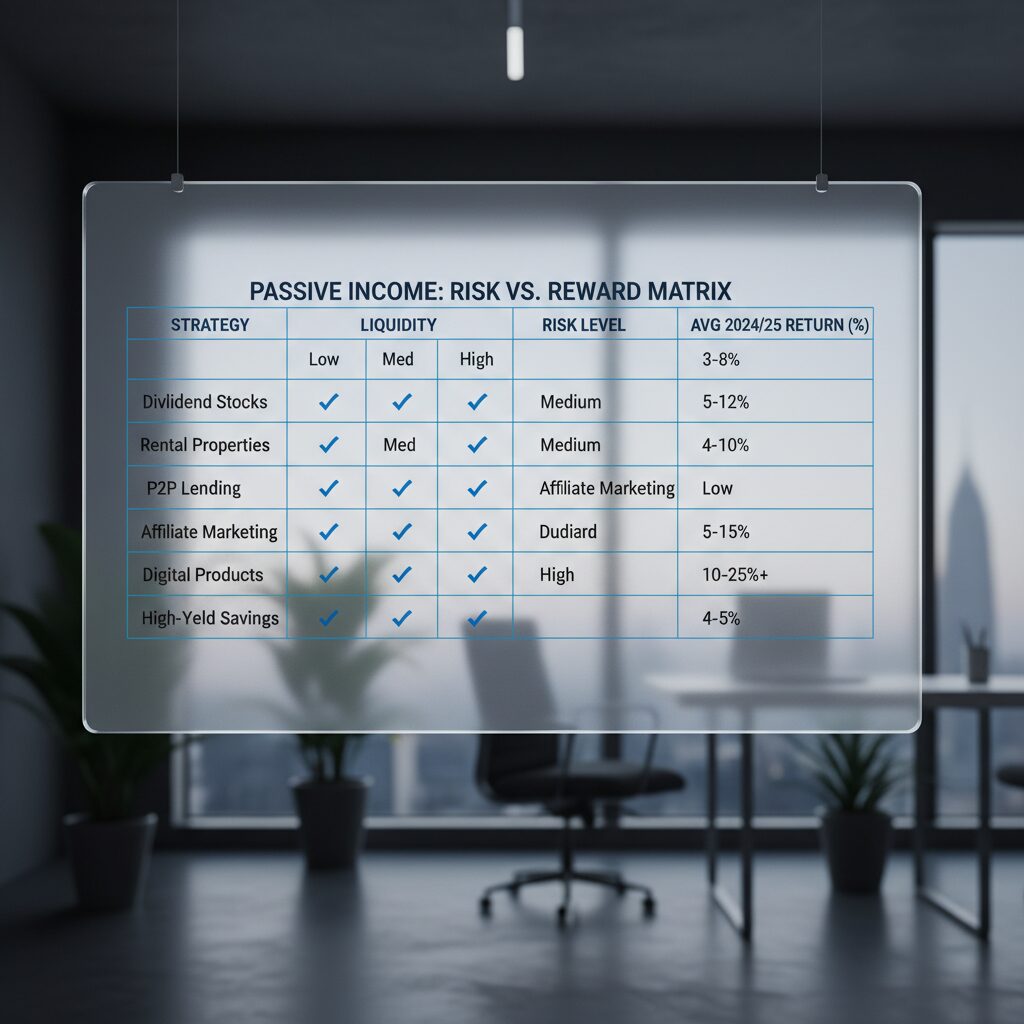

I would be doing you a disservice if I didn’t talk about risk. Low cost does not mean low risk. Here is how the strategies compare:

| Strategy | Min Investment | Liquidity | Avg Return (2024/25 Data) |

|---|---|---|---|

| Public REITs | $10 – $100 | High (Instant) | ~4.9% (Sector Dependent) |

| Fractional (Arrived) | $100 | Low (5+ Years) | ~5.14% |

| Crowdfunding (Fundrise) | $10 | Low (Quarterly) | ~5.75% |

| Private Debt | $10 – $1,000 | Medium (<1 Year) | 8% – 10% |

Frequently Asked Questions

Can you really make passive income from real estate with $100?

Absolutely. Through fractional platforms like Arrived Homes or by purchasing shares of a REIT like Realty Income, $100 gets you immediate exposure. If you invested $100 in a REIT yielding 5%, you would earn $5 a year. It sounds small, but the key is compounding (reinvesting those dividends) and adding monthly contributions.

How is rental income taxed for passive investors?

This is where it gets interesting. REIT dividends are generally taxed as ordinary income. However, fractional ownership and crowdfunding often pass through depreciation benefits. This means you might receive cash distributions, but show a “loss” on paper, reducing your tax burden. Always consult a CPA, but know that “passive losses” can be a powerful tool.

Is fractional real estate ownership worth it?

It is worth it if you prioritize access over control. You won’t get rich overnight, but you are accessing an asset class that was previously gated behind a $50k paywall. With Lofty.ai reporting that 60% of fractional investors are under 40, it’s clear this is the preferred vehicle for the next generation of wealth builders.

Conclusion: Start With Your First $100

The era of needing a massive down payment to enter the real estate market is over. The barriers have crumbled.

Whether you choose the liquidity of a public REIT, the stability of a debt fund, or the innovative model of fractional ownership, the most important step is the first one. The data from 2024 and 2025 shows a market in recovery—yields are healthy, and valuations are attractive.

Here is your action plan:

- If you have $100: Open a brokerage account and buy one share of a high-yield REIT or explore Arrived Homes.

- If you have $1,000: Split it between a Growth REIT (like Fundrise) and a Debt platform for balance.

- If you have $5,000: Look at high-yield markets like St. Louis or consider financing an ADU.

Don’t wait for the “perfect” time. In real estate, time in the market almost always beats timing the market.