How to Build Passive Income with Dividend Stocks: The 2025 Guide

Imagine a paycheck that arrives whether you work, sleep, or travel. It doesn’t require you to answer emails, manage tenants, or launch a side hustle. This isn’t a get-rich-quick scheme; it is the mathematical certainty of dividend growth investing.

In my years of analyzing market cycles, I’ve noticed a recurring pattern: beginners chase the highest numbers they see today, while wealthy investors focus on the durability of income tomorrow. You might be wondering, “Is it really possible to live off dividends in 2025 given the current market valuations?”

The short answer is yes, but the rules have changed. With the S&P 500 dividend yield hovering around historically low levels (approx. 1.14% – 1.27% as of late 2024 according to data from Multpl), blind buying is a recipe for failure. You need a strategy that blends “Aristocrats,” tax optimization, and a strict avoidance of “yield traps.”

In this guide, we will move beyond theory. We will cover the exact payout ratios, the 2025 tax brackets you need to know, and the portfolio construction methods used to build an income stream that survives market crashes.

The Mathematics of Dividend Passive Income

Many people misunderstand dividends. They view them as a “bonus” rather than the primary driver of wealth. However, history paints a different picture. If you look at the mechanics of total return, dividends are the heavy lifters.

According to a March 2025 report by Hartford Funds, from 1960 through 2024, 85% of the cumulative total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding.

The “Yield on Cost” Secret

This is the concept that changed my entire perspective on investing. Most people look at the current yield—what a stock pays today relative to its price. But as a long-term investor, you should care about Yield on Cost (YOC).

Let’s say you buy a stock at $100 with a $3 dividend (3% yield). If the company raises that dividend by 10% annually (common for Dividend Aristocrats), in 7 years, you are receiving roughly $6 per share. Your yield on your original $100 investment is now 6%, regardless of the current stock price. Over decades, this YOC can exceed 20% or 30%. This is how retirees eventually generate massive income from modest initial investments.

How Much Capital Do You Actually Need?

A common question I get is, “How much do I need to invest to quit my job?” The traditional “Rule of 25” (saving 25 times your annual expenses) applies broadly to retirement, but for a pure dividend portfolio, we look at the yield.

If you target a safe, blended portfolio yield of 3.5% (combining lower-yielding growth stocks and higher-yielding sector stocks):

- To generate $1,000/month ($12,000/year), you need approx. $342,857 invested.

- To generate $4,000/month ($48,000/year), you need approx. $1.37 million invested.

This sounds like a lot—and it is. But remember the “snowball.” You don’t save $1.37 million; you save a fraction of that, and dividend reinvestment (DRIP) bridges the gap over time.

Choosing Your Income Engines: Growth vs. Yield

Not all dividend stocks are created equal. In my experience, a healthy portfolio balances three distinct “buckets” of assets.

1. The Dividend Aristocrats & Kings (Safety First)

These are the bedrock of any passive income strategy. S&P 500 Dividend Aristocrats are companies that have increased their dividend for at least 25 consecutive years. Dividend Kings have done it for 50+ years.

According to Seeking Alpha data from late 2025, Dividend Aristocrats delivered an average annual dividend growth of approximately 5.46%. While they may not offer the highest starting yields, their ability to raise payouts faster than inflation is crucial for preserving your purchasing power.

Furthermore, S&P Global research indicates that Aristocrats historically exhibit lower volatility (beta) than the broader market, offering downside protection during recessions.

2. High-Yield Sectors: REITs and BDCs

To boost your portfolio’s average yield, you can look toward Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs). These entities are required by law to distribute 90% of their taxable income to shareholders.

However, this comes with a catch: taxes. Dividends from REITs are generally considered “ordinary income,” not the tax-advantaged “qualified dividends” we see from standard corporations. (More on this in the tax section).

Based on January 2025 data from NYU Stern, sectors like Utilities and Real Estate often maintain payout ratios exceeding 60%, reflecting their stable cash flow models but limited growth potential compared to tech.

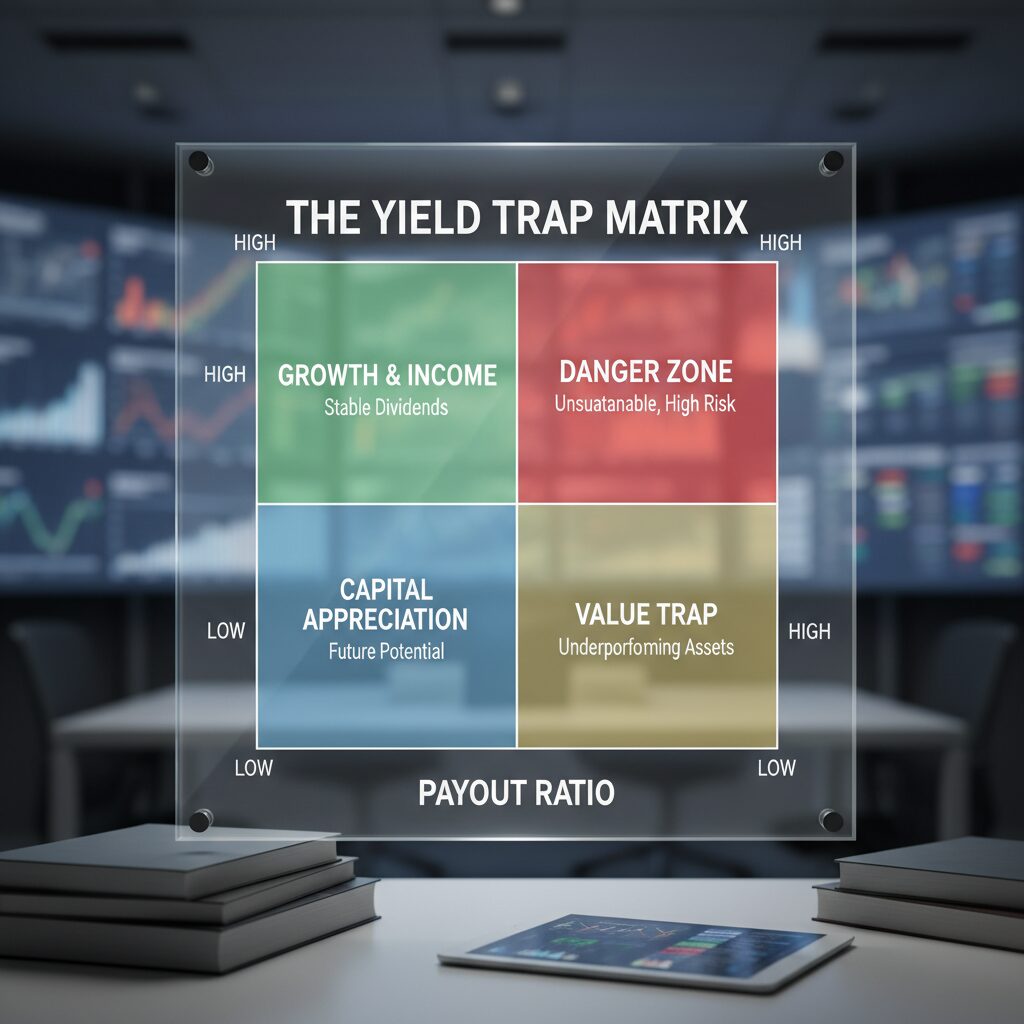

Critical Warning: Spotting the “Yield Trap”

This is where I see most beginners lose money. They sort a stock screener by “Highest Yield” and buy a company paying 12%. Don’t do this.

— Dan Lefkovitz, Strategist at Morningstar (October 2025)

Case Study: The Frontier Communications Trap

Let’s look at a historical warning. In 2017/2018, Frontier Communications was tempting investors with a massive 29% yield. It seemed like a cash cow. However, the payout ratio was well over 100% (they were paying out more than they earned). The result? As analyzed by The Motley Fool, the stock price tanked over 85%, the dividend was suspended, and the company eventually filed for Chapter 11 bankruptcy. The yield was a mirage.

The Payout Ratio Danger Zone

How do you avoid this? Check the Payout Ratio (Dividends ÷ Earnings). Here are my personal thresholds for safety:

- General Stocks: Look for a ratio under 60%.

- Utilities/Telecom: Under 75% is acceptable due to predictable cash flows.

- REITs/BDCs: Look at “AFFO” (Adjusted Funds From Operations) payout ratios rather than standard earnings. Under 90% is generally safe.

According to a Hartford Funds study, companies in the top quintile of dividend yield have historically underperformed those in the second quintile. This data confirms that “chasing yield” is statistically a losing strategy.

The Tax Reality (2025 Updates)

If you are building this portfolio in a standard brokerage account, you must understand the “tax drag.” Taxes reduce the efficiency of your compounding.

Qualified vs. Non-Qualified Dividends

Most U.S. corporations pay “qualified” dividends, which are taxed at long-term capital gains rates—much lower than your regular income tax rate. However, to benefit from this, you must hold the stock for more than 60 days during the 121-day period surrounding the ex-dividend date.

Here are the 2025 Qualified Dividend Tax Brackets based on IRS Revenue Procedure 2024-40:

| Tax Rate | Single Filer Income (2025) | Married Filing Jointly (2025) |

|---|---|---|

| 0% | Up to $48,350 | Up to $96,700 |

| 15% | $48,351 to $533,400 | $96,701 to $600,050 |

| 20% | Over $533,400 | Over $600,050 |

According to TurboTax’s 2025 guide, single filers earning under $48,350 pay effectively zero federal tax on their qualified dividends. This is a massive advantage for lean FIRE (Financial Independence, Retire Early) strategies.

Step-by-Step Portfolio Construction

So, how do we put this all together into a cohesive plan? Here is the framework I use.

Step 1: Brokerage Selection & DRIP Activation

You need a brokerage that supports fractional shares and automatic Dividend Reinvestment Plans (DRIP). Platforms like Fidelity, Schwab, or M1 Finance are excellent for this. DRIP is the engine of compounding; it takes your cash dividend and immediately buys more shares of the stock, no matter the price.

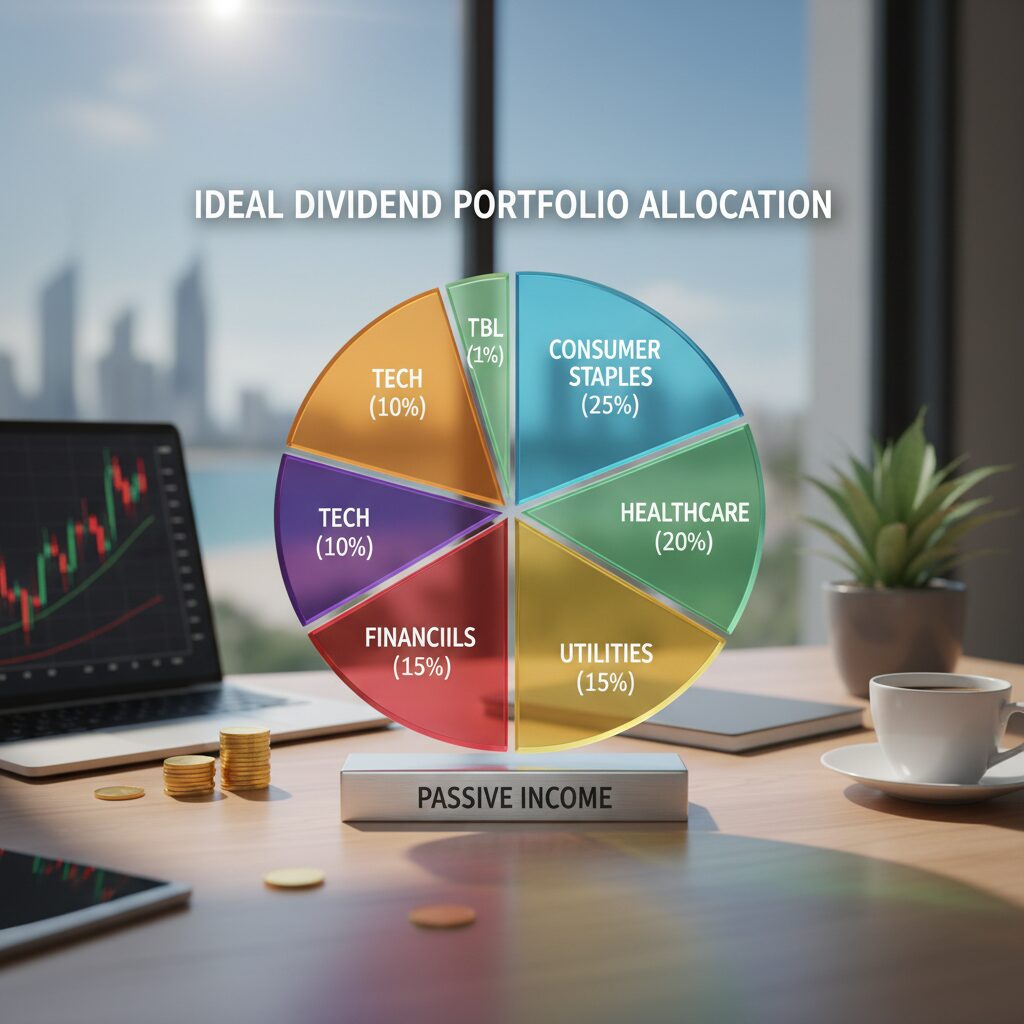

Step 2: Sector Diversification (The 30% Rule)

Never fall in love with one sector. In 2020, energy dividends were slashed. In 2008, financial dividends vanished. I recommend a hard cap: no single sector (e.g., Tech, Healthcare, Energy) should make up more than 30% of your income stream.

Data from Nuveen’s 2024 insights suggests that dividend growers and initiators generated higher returns with less risk than companies that merely maintained dividends from 1973-2024. This supports a diversified approach focused on growth rather than just current yield.

Step 3: The Maintenance Schedule

This is “passive” income, but it requires “active” monitoring. I suggest a quarterly review. You aren’t checking stock prices daily; you are checking the business fundamentals:

- Has the payout ratio spiked above safety limits?

- Has the company borrowed money to pay the dividend? (A massive red flag).

- Is the free cash flow still covering the dividend?

Real-World Psychology: The First $100 is the Hardest

I want to close with a story about “Adrian,” a well-known figure in the dividend investing community (Passive Income Investing). In a July 2025 interview, he noted that the psychological barrier of the first $1,000 in dividends is significantly harder than the subsequent $10,000.

Why? Because in the beginning, the numbers feel insignificant. You invest $1,000 and get $30 a year. It feels like nothing. But as Warren Buffett famously said in his shareholder letters (analyzed by Motley Fool in late 2024), “The best investments are ones that return more cash each year without someone buying more shares.”

When you cross the “crossover point”—where your dividends earn more dividends than your monthly cash contributions—the snowball becomes an avalanche. That is the moment you effectively win the game.

Conclusion

Building passive income with dividend stocks is a test of patience, not IQ. It requires you to ignore the flashiness of speculative tech rallies and fall in love with boring, cash-generative businesses.

Start by identifying high-quality Dividend Aristocrats. Filter them for safe payout ratios (avoid the yield traps!). Understand your tax liability for 2025, and use Roth IRAs where appropriate. If you can commit to this process, the math is entirely on your side.

The best time to plant a tree was 20 years ago. The second best time is today. Your future self is waiting for that first dividend check.

Frequently Asked Questions

Are dividends considered passive income by the IRS?

Yes, for the most part, the IRS classifies dividends as unearned income (passive). However, they are taxed differently than rental passive income. Qualified dividends are taxed at capital gains rates (0%, 15%, or 20%), while non-qualified dividends are taxed as ordinary income.

Can you lose money with dividend stocks?

Absolutely. If a company’s stock price drops significantly, the capital loss can exceed the dividend income. Furthermore, dividends are not guaranteed; companies can cut or suspend them at any time (as seen with Disney and Ford in 2020).

What is a good dividend yield in 2025?

In the current interest rate environment, a “safe” yield for a growing company is typically between 2% and 4%. Yields consistently above 5-6% (outside of REITs/BDCs) warrant extreme caution and deep investigation into the payout ratio.

How often are dividends paid out?

Most U.S. companies pay dividends quarterly (four times a year). However, some popular “monthly dividend stocks” (like Realty Income) pay 12 times a year, which is popular for retirees budgeting monthly expenses.