How to Find Reliable Dividend Passive Income: A 2025 Strategy Guide

I still remember the first time I got “paid” for doing absolutely nothing. It was a check for $14.32. It wasn’t life-changing money—it was barely lunch money—but it changed my life because I didn’t have to trade my time to get it.

But here is where most investors crash and burn. In my 15 years analyzing market trends, I’ve seen countless people chase double-digit yields, thinking they’ve found a “money glitch,” only to watch the stock price collapse by 50% when the dividend is inevitably cut. Chasing the highest yield is the fastest way to lose your principal. True passive income comes from dividend reliability, not just the percentage on the screen.

In this guide, we aren’t just looking for stocks; we are building a 2025-proof income engine. We will walk through the institutional screening process to help you find companies that pay you to hold them, regardless of what the Federal Reserve or inflation does next.

Why “Reliable” Beats “High Yield” in 2025

It’s tempting to filter your stock screener by “Yield: Highest to Lowest.” However, a yield that looks too good to be true usually is. This is known as the “Yield Trap.” A 10% yield often exists because the stock price has plummeted due to underlying business failures.

The goal isn’t just income today; it’s total return. According to a March 2025 report from Hartford Funds, from 1940 through 2024, dividend income’s contribution to the total return of the S&P 500 Index averaged a staggering 34%. If you ignore dividends and reliability, you are ignoring a third of the market’s historical return.

Furthermore, reliability protects you from volatility. Data from S&P Dow Jones Indices (Feb 2025) indicates that Dividend Aristocrats—companies that have increased payouts for 25+ years—historically exhibit lower volatility than the broader market during drawdowns. In a year like 2025, where uncertainty still lingers, reliability is your defense mechanism.

The 4 Pillars of Dividend Safety (Screening Methodology)

How do you actually find these companies? You don’t listen to TV pundits. You look at the data. When I screen for a new position, I use these four non-negotiable pillars.

1. Payout Ratio Analysis (The “Room to Breathe” Metric)

The payout ratio is the percentage of earnings a company pays out as dividends. A ratio that is too high means the company isn’t reinvesting enough to grow, or worse, is borrowing money to pay you.

However, you cannot use a single number for every stock. Sectors behave differently. According to NYU Stern’s 2025 Sector Data, the average dividend payout ratio for the Utility sector is roughly 65-70%, while the Technology sector averages below 30%. A utility paying 70% is normal; a tech company paying 70% is a red flag.

2. Free Cash Flow (FCF) Coverage

This is the metric that separates the pros from the amateurs. Dividends are paid from cash, not “Net Income,” which can be manipulated by accounting tricks.

I always look for Free Cash Flow (FCF). If a company generates $1 billion in FCF and pays out $500 million in dividends, that dividend is safe. If they report $1 billion in “Earnings” but have negative FCF, that dividend is living on borrowed time.

3. Dividend History: Aristocrats and Kings

Past performance doesn’t guarantee future results, but it leaves clues. I look for companies that have raised dividends through the 2000 Dot-com crash, the 2008 Financial Crisis, and the 2020 Pandemic.

According to Investopedia analysis (2025), investing in funds that track the S&P 500 Dividend Aristocrat Index is a prime strategy for reliability, as these companies have consistently raised dividends for at least 25 consecutive years.

4. Debt-to-Equity

In a high-interest-rate environment, debt is a killer. Companies with high leverage ratios will spend more cash servicing debt than paying you. I generally avoid any company with a Debt-to-Equity ratio significantly higher than its sector average.

Best Sectors for Reliable Dividends in 2025

Where should you be looking right now? Based on the economic landscape of 2025, certain sectors offer better risk-adjusted returns.

Utilities and Consumer Staples

These are “defensive” plays. People will keep the lights on and buy toothpaste regardless of the economy. While they offer lower capital appreciation, their income reliability is top-tier.

Real Estate Investment Trusts (REITs)

REITs are legally required to pay out 90% of their taxable income as dividends. However, they are sensitive to interest rates. Roger Hallam, Vanguard Global Head of Rates, noted in mid-2024 that potential Fed easing would provide a tailwind for income assets. With rates stabilizing in 2025, high-quality REITs with low leverage are becoming attractive again.

Warning: REIT dividends are usually taxed as ordinary income, not the lower qualified dividend rate. Always check the tax status.

Tax Implications for Dividend Investors (2025 Update)

It’s not about what you make; it’s about what you keep. Taxes can eat up to 37% of your passive income if you aren’t careful. Here is how the landscape looks for the 2025 tax year.

Qualified vs. Ordinary Dividends

Most dividends from US corporations are “Qualified,” meaning they are taxed at the long-term capital gains rate (0%, 15%, or 20%) rather than your income tax rate. Ordinary dividends (like those from REITs or BDCs) are taxed at your marginal income bracket.

| Tax Rate | Single Filers (Taxable Income) | Married Filing Jointly |

|---|---|---|

| 0% | Up to $48,350 | Up to $96,700 |

| 15% | $48,351 to $533,400 | $96,701 to $600,050 |

| 20% | Over $533,400 | Over $600,050 |

To qualify for these rates, you must hold the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date.

Step-by-Step: How to Build Your Portfolio

You have the knowledge; now let’s execute the strategy. I recommend a simple, disciplined approach to building your dividend ladder.

1. Determine Your “Number”

Don’t just say “I want more money.” Calculate exactly how much yield you need to cover specific bills. This turns an abstract goal into a concrete target.

2. The Power of DRIP (Dividend Reinvestment Plans)

If you don’t need the cash immediately to pay bills, you must reinvest it. This is the eighth wonder of the world: compound interest.

According to Hartford Funds data, an initial $10,000 investment in the S&P 500 in 1960 would have grown significantly on price alone, but with dividends reinvested, the total return is roughly 85% higher. This “snowball effect” is how generational wealth is built.

🧮 Simple Dividend Income Estimator

Calculate your potential annual passive income based on yield.

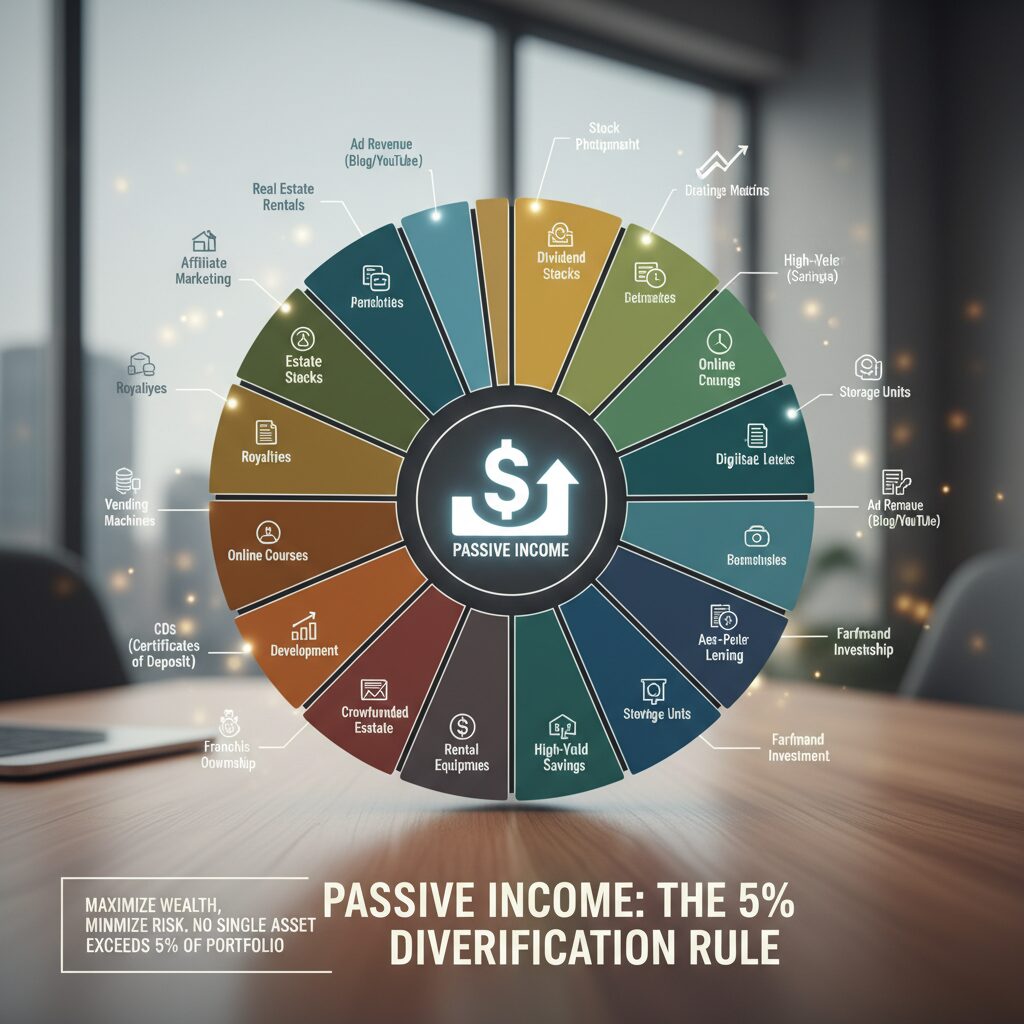

3. The 5% Diversification Rule

In my opinion, the biggest mistake new investors make is falling in love with a single stock. No matter how reliable a company looks, black swan events happen. I strictly follow the 5% rule: never allow a single position to exceed 5% of your total portfolio value. If it grows larger than that, trim it and reallocate.

Frequently Asked Questions

How much do I need invested to make $1,000 a month in dividends?

To generate $1,000 a month ($12,000 annually), it depends on your yield. If you build a safe portfolio with a 4% yield, you would need $300,000 invested. If you chase a riskier 8% yield, you need $150,000, but remember: higher yield brings higher risk of cuts.

Are dividends taxed if I reinvest them?

Yes. This surprises many people. Even if you use a DRIP to automatically buy more shares and never touch the cash, the IRS considers that dividend as income received in the year it was paid (unless it is in a tax-advantaged account like a Roth IRA).

What is a good dividend payout ratio?

As mentioned in the sector analysis section, “good” varies. Generally, for standard corporations, a payout ratio below 60% is considered safe. For REITs and BDCs, a payout ratio under 90% is often acceptable due to their tax structures.

Conclusion

Finding reliable dividend passive income isn’t about gambling on the next hot stock. It’s about acting like a bank. It requires analyzing Free Cash Flow, understanding the tax drag on your returns, and having the discipline to ignore high-yield traps.

In 2025, consistency beats intensity. A boring, reliable 4% yield that grows every year will do more for your financial freedom than a volatile 12% yield that keeps you up at night. Start small, verify the payout history, and let compounding do the heavy lifting.

Disclaimer: I am not a financial advisor. This article is for educational purposes only. Always consult with a certified financial planner or tax professional before making investment decisions.