Dividend Reinvestment for Passive Wealth: The 2025 Compounding Guide

Albert Einstein reportedly called compound interest the “eighth wonder of the world.” While the quote’s origin is debated, the mathematics behind it are undeniable. In 2025, dividend reinvestment acts as the practical application of that wonder—turning a modest trickle of income into a roaring river of passive wealth.

If you have ever felt like your portfolio is stagnating despite a rising market, you might be missing the hidden engine of total return. Most investors focus entirely on stock price appreciation (the “buy low, sell high” mentality), ignoring the cash flow that companies pay out quarterly.

Here is the reality check: According to a landmark 2024 study by Hartford Funds, approximately 69% of the S&P 500’s total return over the last 60 years didn’t come from stock prices going up—it came from reinvested dividends.

In this guide, I won’t just sell you on the dream of passive income. I am going to walk you through the mechanics of the “snowball effect,” break down the new 2025 tax implications that could eat your profits, and show you exactly how to set up your brokerage account to automate your wealth building.

The Mathematics of Wealth: Why Reinvestment Wins

To understand why dividend reinvestment (often executed through a DRIP, or Dividend Reinvestment Plan) is superior to taking the cash, we have to look at the difference between price return and total return.

The “Magic” of Compounding Explained

When a company pays you a dividend, you have two choices: take the cash and buy a nice dinner, or buy more shares of that company. If you choose the latter, you now own more shares. Next quarter, those new shares also earn dividends, which buys even more shares. This is the snowball effect.

In my experience analyzing portfolios, the investors who treat dividends as “bonus spending money” rarely achieve true financial independence. Those who treat dividends as “seed capital” for new shares are the ones who retire early.

Price Return vs. Total Return: The Hidden 69%

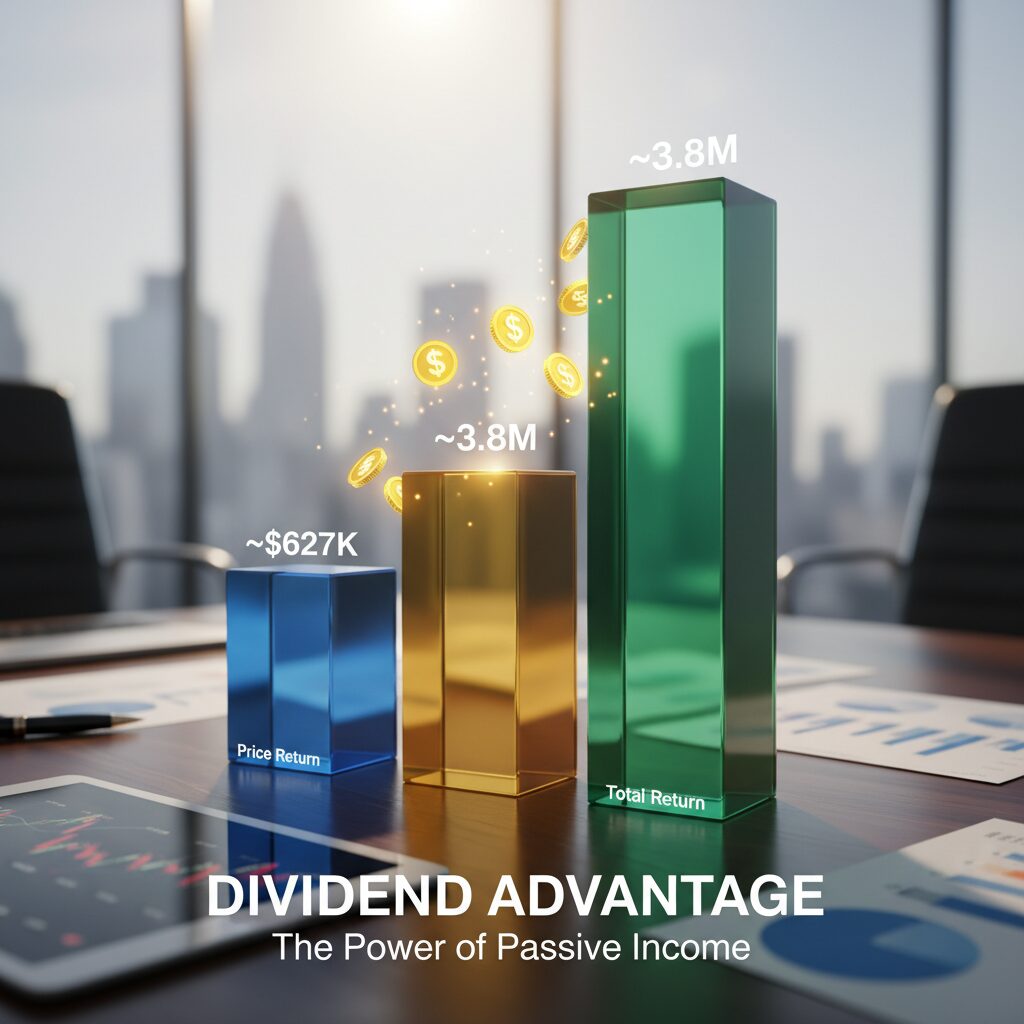

The gap between price return (stock value only) and total return (stock value + reinvested dividends) is staggering.

S&P 500 Return from Dividends (1960-2023)

Dividends’ Contribution to Total Return (1940-2023)

According to Hartford Funds’ 2024 report, “The Power of Dividends”, from 1960 to 2023, 69% of the market’s total return came from reinvested dividends and the power of compounding. If you ignore dividends, you are effectively fighting with one hand tied behind your back.

Analyzing the Data: The $10k Experiment

Let’s look at the raw numbers. Data from Morningstar and Hartford Funds illustrates the devastating opportunity cost of not reinvesting.

Imagine you invested $10,000 in the S&P 500 in 1960 and held it until the end of 2023.

| Strategy | Final Portfolio Value | The Verdict |

|---|---|---|

| Price Only (Spend the dividends) | $627,161 | Good growth, but inflation eats much of it. |

| Total Return (Reinvest dividends) | $3,845,730 | Generational wealth. |

That is a difference of over $3.2 million. According to Hartford Funds, this massive disparity highlights that time in the market combined with reinvestment is the primary driver of equity performance.

Volatility Dampening: The Bear Market Shield

Dividends don’t just boost returns; they protect your sanity. In bear markets, stock prices fall, which means your reinvested dividends purchase more shares at a discount.

Morningstar analysts noted in their 2024 research, “Why Dividends Matter”, that reinvesting during downturns naturally lowers your average cost per share. When the market eventually recovers, you own significantly more shares than when the crash started, accelerating your recovery.

How to Execute: DRIPs vs. Synthetic Reinvestment

Now that we know the why, let’s look at the how. In the old days, you had to mail forms to transfer agents. In 2025, it’s digital, but there are nuances.

1. Traditional DRIPs (Company-Run)

These are plans administered directly by the company (e.g., Coca-Cola or Proctor & Gamble). They often allow you to buy shares without commissions directly from the firm. However, with most modern brokerages offering $0 commission trading, these are becoming less necessary for the average retail investor.

2. Brokerage “Synthetic” DRIPs

This is what 99% of you should be using. Major brokerages like Fidelity, Vanguard, and Schwab allow you to toggle a setting to “Reinvest Dividends.”

- Fractional Shares: If you receive a $5 dividend and the stock costs $100, a modern broker will buy you 0.05 shares. This ensures every penny is working immediately.

- Automation: It happens largely in the background. You wake up, and you own more of the company.

3. Accumulating vs. Distributing ETFs

For my international readers (outside the US), this is critical. In many jurisdictions (like Ireland-domiciled ETFs), you can choose an “Accumulating” ETF. These funds automatically reinvest dividends internally within the fund structure, which can have significant tax advantages depending on your country’s laws. In the US, however, funds are generally required to distribute yield to shareholders.

The Tax Reality: Navigating the 2025 Landscape

This is where the “free money” concept hits a speed bump. Many beginners assume that because they didn’t take the cash out of the account, they don’t owe taxes. This is false.

⚠️ Important 2025 Tax Rule

In a standard taxable brokerage account, reinvested dividends are taxable in the year they are received. The IRS treats it as if you received the cash and immediately bought the stock yourself.

Qualified vs. Non-Qualified Dividends

Your tax bill depends on the type of dividend.

- Qualified Dividends: Taxed at long-term capital gains rates (0%, 15%, or 20%). Most US corporations fall here.

- Non-Qualified (Ordinary) Dividends: Taxed at your regular income tax bracket (up to 37%). This includes REITs (Real Estate Investment Trusts) and BDCs.

2025 Tax Brackets for Qualified Dividends

According to IRS Revenue Procedure 2024-40, the inflation-adjusted brackets for 2025 offer a generous runway for tax-free income.

| Tax Rate | Single Filer Income | Married Filing Jointly |

|---|---|---|

| 0% | Up to $48,350 | Up to $96,700 |

| 15% | $48,351 – $533,400 | $96,701 – $600,050 |

| 20% | Over $533,400 | Over $600,050 |

The “Tax Drag” Calculator

The difference between reinvesting in a Roth IRA (Tax-Free) vs. a Brokerage Account (Taxable) is called “Tax Drag.” Let’s calculate the impact.

Simple Tax Drag Estimator

Estimate how much taxes reduce your compounding over time.

*Note: This is a simplified calculation assuming stock price remains flat to isolate dividend compounding impact. Real world returns would include price appreciation.

Real-World Case Studies: Portfolios in Action

Theory is great, but let’s look at real execution.

The “Joseph Carlson” Method

Joseph Carlson runs a popular, transparent financial channel where he tracks a dividend portfolio publicly. In his 2024 portfolio review, his portfolio balance hovered around $750,000. The key metric? It generated over $8,700 in projected annual dividend income for 2024 alone.

What I find fascinating about this case study is the “snowball” progression. In the early years, his income was under $500. Through aggressive contribution and automated fractional reinvestment via M1 Finance, the income stream has become substantial enough to cover major living expenses—without selling a single share.

The Dividend Growth Portfolio (16.2% Yield on Cost)

A long-running series on Seeking Alpha, “The Dividend Growth Portfolio,” provided a 2024 review showing a Yield on Cost of 16.2%. This means that for every $100 originally invested in 2008, the portfolio now pays out $16.20 every single year in dividends. This proves Warren Buffett’s philosophy from his 2023 Shareholder Letter: “Growth occurred every year, just as certain as birthdays.”

5 Common Pitfalls to Avoid

Even with a solid strategy, there are traps. In my years of consulting, these are the most common errors:

- Chasing Yield (The Trap): Buying a stock solely because it has a 10% yield. Often, the yield is high because the stock price has collapsed due to business failure.

- Ignoring Valuation: Reinvesting dividends when a stock is drastically overvalued (P/E ratio > 30 for a slow grower) buys you fewer shares. Some investors stockpile cash during bubbles and reinvest during dips.

- Over-Concentration in REITs: While REITs pay high dividends, they are taxed as ordinary income. Putting these in a taxable account instead of an IRA is a tax efficiency nightmare.

- The “Free Money” Fallacy: Remember, when a dividend is paid, the stock price drops by the exact amount of the dividend. You aren’t “gaining” money instantly; you are gaining the ability to compound over time.

- Unrealistic Expectations: As of Dec 31, 2024, Multpl data shows the S&P 500 yield is around 1.24%. Do not expect to replace your salary next year with a $10,000 account. This is a decades-long game.

FAQ: Dividend Reinvestment Strategy

Yes. Even if you never touch the cash, the IRS counts reinvested dividends as taxable income in the year they are received, unless the assets are held in a tax-advantaged account like a Roth IRA or 401(k).

No, it actually increases your total tax basis. Each reinvestment is treated as a new purchase block of shares at the current market price. This is actually good news—when you eventually sell, a higher cost basis means lower capital gains taxes.

Absolutely. In fact, it is most important for small portfolios. The ability to buy fractional shares means even a $5 dividend is put to work immediately. Waiting to accumulate $1,000 to buy a full share creates “cash drag” where your money sits idle.

Yes. If the underlying stock price drops to zero, your principal and your reinvested dividends are lost. Reinvestment accelerates wealth in a rising market, but it also increases exposure in a falling one. Quality selection (like Dividend Aristocrats) is key.

Conclusion: The Engine of Your Future

Dividend reinvestment is not a “get rich quick” scheme. It is a “get wealthy inevitably” strategy. The data from Hartford Funds is irrefutable: 69% of the market’s return comes from the compounding of dividends. By ignoring this, you are leaving the majority of historical market returns on the table.

In 2025, with favorable tax brackets for qualified dividends and technology that allows for seamless, fractional reinvestment, there is no excuse not to automate this process. Whether you are building a $1000 a month income stream or aiming for a multi-million dollar retirement, the math remains the same.

Your immediate action item: Log into your brokerage account today. Look for the “Dividend Reinvestment” or “DRIP” settings. Toggle it to “On” for your core holdings. Your future self—20 years from now—will thank you for that single click.